An artificial intelligence model suggests that XRP is expected to remain relatively stagnant, trading below the $2 threshold as it approaches March 1, 2026. The cryptocurrency has faced challenges recently, primarily due to a significant market sell-off initiated by Bitcoin (BTC). Currently, XRP is trading below the $1.50 mark, reflecting ongoing market pressures.

In an analysis conducted by Finbold, insights from OpenAI”s ChatGPT indicate that XRP might fluctuate between $1.35 and $1.75 on the specified date, with a median price around $1.55 if the market conditions are moderately favorable. Should a bullish scenario materialize, characterized by enhanced sentiment and increased trading volumes, XRP could potentially rise to the $1.70 to $1.90 range.

To achieve such upward movement, a breakthrough beyond short-term resistance levels, along with potential short squeezes and favorable technical indicators like a bullish crossover on shorter-term moving averages, could attract momentum traders, further driving prices up. Conversely, a neutral outlook suggests that XRP may consolidate between $1.35 and $1.55, reflecting a lack of significant catalysts and trading within established support near $1.30 and resistance around $1.50.

ChatGPT also pointed out that XRP tends to mirror broader trends in the cryptocurrency market, which means that stagnant market conditions could confine its price action. In a more pessimistic scenario, ongoing selling pressure coupled with unfavorable market conditions might drive prices down to the $1.10 to $1.30 range, particularly if critical support levels are compromised and risk-off sentiment grows.

The short 15-day window leading into March 1 is a crucial period in crypto markets. Though rapid price movements can occur, they are less likely without significant news or a dramatic shift in investor sentiment. Resistance levels are clustered around $1.50 to $1.60, while support hovers near $1.30 to $1.35, establishing a framework for the near-term outlook.

Despite the reliance on market sentiment, investors in XRP are hopeful that pivotal developments related to Ripple could act as catalysts for price appreciation. With Ripple“s aggressive expansion strategy and commitment to ecosystem development, there may be fresh fundamentals that could spur a rally, even as the token remains approximately 60% below its all-time high.

CEO Brad Garlinghouse indicated that the company could resume acquisitions in the latter half of 2026 after a substantial investment in mergers and acquisitions during the previous year. While 2026 will primarily focus on integrating these prior deals, Ripple has hinted at renewed acquisition activity later in the year, including a noteworthy $1.25 billion acquisition of Hidden Road, a prime brokerage platform, and a $1 billion deal for GTreasury, which is now functioning as Ripple Treasury.

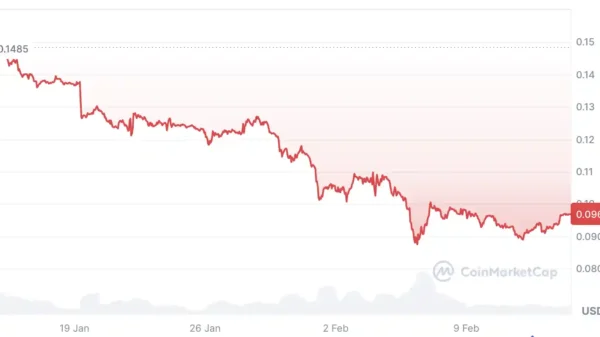

As of the latest data, XRP is trading at $1.43, reflecting a gain of over 5% in the last 24 hours, while its weekly performance shows an increase of about 1%. Notably, XRP is still below its key moving averages, indicating persistent downside pressure. The 50-day simple moving average (SMA) stands at $1.85, significantly above the current price, highlighting a weakened short- to mid-term momentum. More critically, the 200-day SMA at $2.36 reinforces a broader bearish trend.

On the momentum front, the 14-day Relative Strength Index (RSI) is currently at 37.98. This places it in neutral territory, though it leans toward oversold conditions. While the RSI has not yet dropped below the 30 threshold, which typically indicates oversold levels, the current figures suggest diminishing buying strength and a lack of robust demand.

Overall, the landscape for XRP remains complex, with various factors influencing its price trajectory as March 1 approaches.