The Growing Issue of Censorship in Ethereum Blockchain

For many believers in blockchain, the technology’s allure lies in its open, uncontrolled nature – where decentralized networks are unfettered by the constraints and biases that shape today’s internet. However, some researchers and users of Ethereum, the world’s second-largest blockchain, are increasingly troubled by data showing a marked increase in censorship.

The Rise of Censorship in Ethereum

A turning point came last year when the U.S. government sanctioned Tornado Cash – a “privacy mixing” program on Ethereum that helped people transact without leaving a trace. The Treasury Department’s Office of Foreign Assets Control (OFAC) said the program was used by terrorists and other U.S.-sanctioned entities, leading to concerns about censorship in Ethereum.

The Impact of Censorship on Ethereum

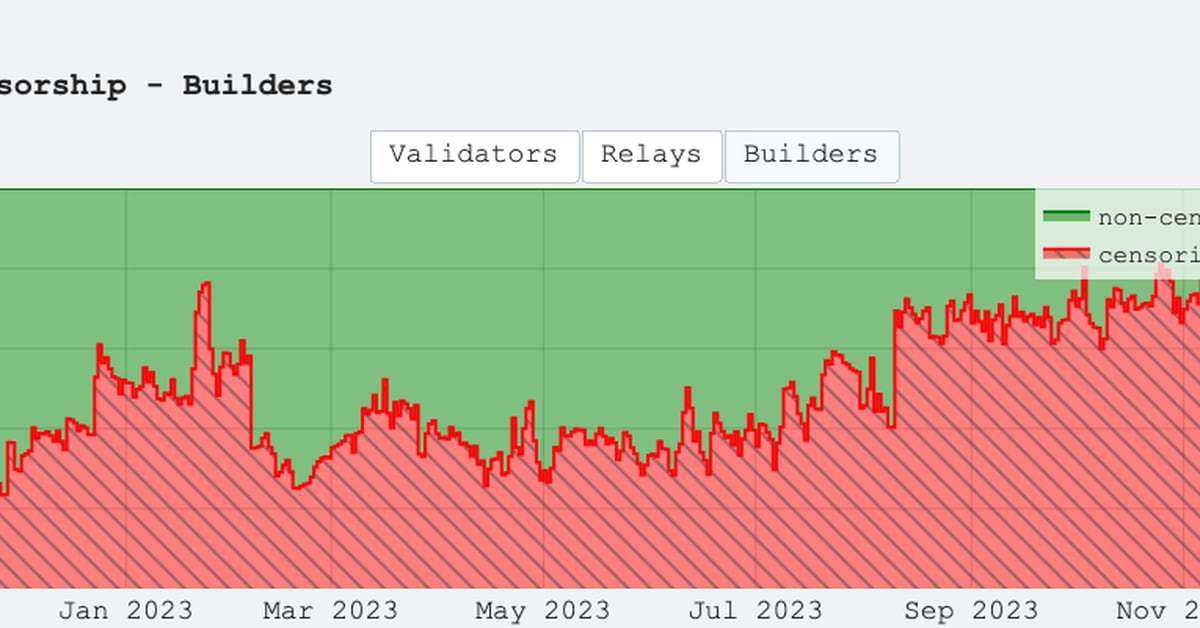

About 72% of data blocks posted to MEV-Boost, middleware that powers almost all of the validators that write blocks to Ethereum, are now considered “censored.” This increase in censorship has raised concerns among blockchain advocates about the decentralized nature of Ethereum.

The Role of Block Builders in Censorship

Block builders have the authority to decide which transactions to include in their blocks, leading to concerns about the content of the blockchain being controlled by a few players. Only one of the five largest block builders claims not to “filter” transactions, highlighting the prevalence of censorship in Ethereum.

The Centralization Issue in Ethereum

Wahrstätter’s research sheds light on how Ethereum’s MEV economy has centralized key elements of the chain’s inner workings, posing potential security risks and threatening the chain’s neutrality. With a small number of builders and relayers dominating Ethereum’s transaction pipeline, concerns about centralization and censorship are growing.

Potential Solutions and Concerns

Efforts to curb censorship in Ethereum include the use of private mempools to guarantee transaction inclusion. However, the normalization of private order flow may introduce new challenges such as higher fees, less transparency, and the reintroduction of middlemen, contradicting the original principles of blockchain technology.