On January 27, a significant movement was observed in the cryptocurrency market as a major whale transitioned $230 million in long positions from Hyperliquid to Aave, focusing on Ethereum investments. This strategic shift underscores a notable change in whale behavior, particularly in relation to leveraging decentralized finance (DeFi) protocols, which could impact Ethereum”s market dynamics and raise volatility concerns at critical price levels.

According to on-chain analyst Yu Jin, this whale closed 30,600 ETH and 427 BTC long positions on Hyperliquid. Subsequently, the whale obtained a loan of $240 million USDT from Aave, transferring these funds to Binance and withdrawing 148,000 ETH, with a liquidation price set at approximately $1,953. This move indicates a calculated strategy, potentially reflecting broader market trends or personal expectations.

The whale”s remaining positions on Hyperliquid, alongside the new ones established on Aave, suggest a concentrated focus on ETH, revealing market anticipations despite Ethereum”s historical price volatility. A thread within the Aave governance noted that “institutional whales are utilizing V3 as a $4.6 billion treasury, with approximately 34.2% of volume via Aave for leverage, involving USDT moving to exchanges or over-the-counter transactions.”

Currently, there have been no official comments from Aave, Binance, or Hyperliquid regarding this whale”s activities. However, the community is closely monitoring the situation for its potential effects on market liquidity, amid circulating unverified speculations about possible further pressure on Ethereum”s price or liquidation risks.

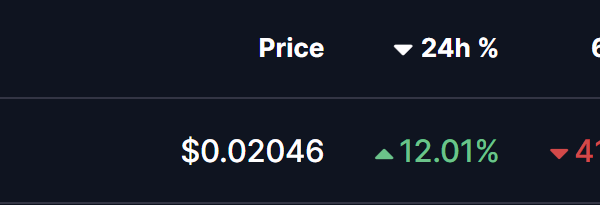

Furthermore, it is noteworthy that leveraged positions similar to those employed by the whale on Aave have been in practice since the DeFi boom in 2017, introducing heightened liquidation risks during volatile market phases, as witnessed in 2021 and 2022. As of January 27, 2026, CoinMarketCap reports Ethereum”s price at $2,935.34, with a market capitalization of $354.28 billion, reflecting a 24-hour change of 2.07%. In the past 90 days, Ethereum has experienced a 26.35% decline, indicating ongoing market fluctuations.

Research from Coincu suggests that the continued use of leverage strategies in DeFi platforms, particularly involving ETH, may lead to increased regulatory scrutiny and adjustments within exchanges. Historical trends indicate that as more whales engage with DeFi protocols, shifts in borrowing rates and liquidity could significantly alter trading dynamics.