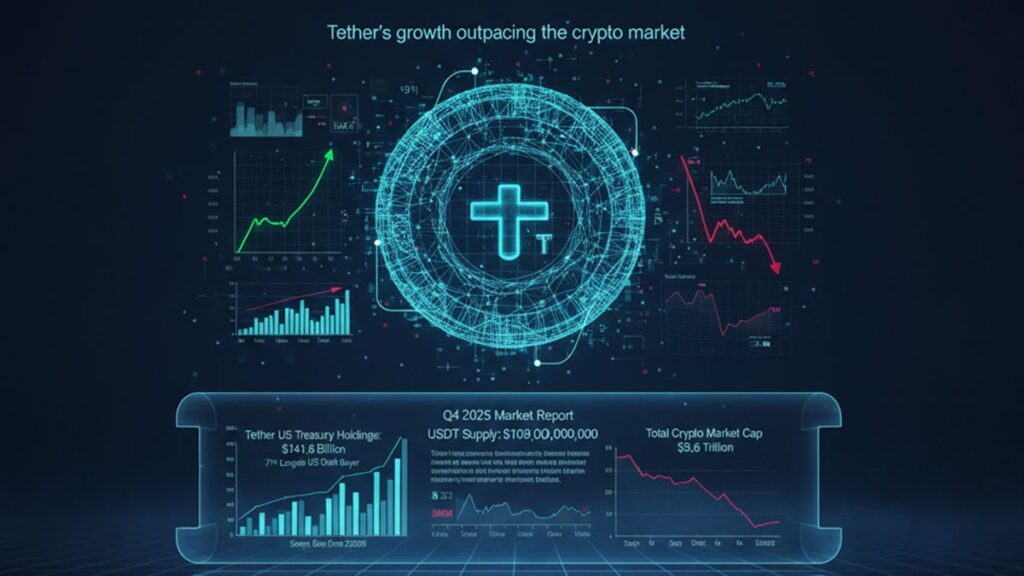

Tether has reported unprecedented growth in the fourth quarter of 2025, solidifying its role in the cryptocurrency ecosystem. While the overall capitalization of digital assets declined by a significant one-third, settling at $2.6 trillion, the circulating supply of USD₮ soared to approximately $109 billion. This remarkable increase underscores Tether”s resilience amid market volatility.

The surge in USD₮ signifies Tether”s dominant position as a safe haven for investors aiming to mitigate risk while remaining within the blockchain environment. As investors exhibit a preference for stablecoins, Tether”s backing by a reserve of $141.6 billion in U.S. Treasury bills reflects a strategic move to maintain dollar-denominated liquidity during bearish market phases.

The shift of capital toward Tether highlights a critical trend, as an uptick in stablecoin balances has historically preceded new accumulation phases, particularly once asset prices stabilize. The crypto market will be observing Tether”s increasing reserves closely, as they represent a pool of “dry powder” that could facilitate swift capital redistribution during future recovery phases.

As Tether continues to establish itself as the seventh-largest global purchaser of U.S. debt, its capacity to mobilize capital effectively will play a pivotal role in shaping the recovery of the digital financial landscape. The implications of this growth for the broader cryptocurrency market are significant, indicating a shift in investor sentiment and a strategic pivot toward stable assets amid ongoing market fluctuations.