A notable trend has emerged within the decentralized finance (DeFi) sector as investors show a marked increase in transactions involving gold-backed tokens. This shift highlights a strategic pivot among DeFi participants who are seeking stability in the face of ongoing market volatility, as noted by Kevin Rusher, founder of RAAC, on January 11, 2026.

This growing interest in gold-backed tokens signifies a potential change in investment behavior within the cryptocurrency community, as these tokens offer a representation of physical gold stored securely and are tradable on blockchain platforms. This integration of gold into DeFi serves to combine the historical stability of gold with the innovative features of blockchain technology.

Gold has long been recognized as a reliable store of value, especially during periods of financial uncertainty. By utilizing DeFi platforms, investors can engage in peer-to-peer financial services, eliminating the need for traditional intermediaries like banks. This facilitates a diverse range of services, including lending, borrowing, and trading, while enabling participants to maintain their exposure to the evolving cryptocurrency market.

However, the rise of gold-backed tokens also raises important regulatory considerations. Regulatory bodies are increasingly focused on ensuring the integrity of financial systems, protecting investors, and preventing fraudulent activities. For companies issuing these tokens, it is imperative to establish robust custody solutions, demonstrate transparency in their operations, and comply with relevant regulations to build and maintain trust among users.

As interest in cryptocurrency and DeFi products grows, large financial institutions and asset managers are exploring opportunities in this space to meet client demands. This represents a significant shift towards integrating traditional financial systems with emerging blockchain technologies.

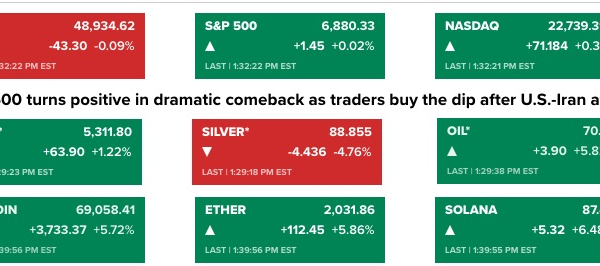

The fluctuating prices of major cryptocurrencies, particularly Bitcoin, have influenced investor sentiment, prompting some to seek refuge in gold, known for its comparatively lower volatility. Platforms like Solana are providing the necessary infrastructure for developing decentralized applications that support gold transactions, further enhancing accessibility for investors.

It is crucial for investors to remain cognizant of the risks posed by gold-backed tokens, which include potential tracking errors, market volatility, and liquidity challenges. Additionally, operational risks and evolving regulatory frameworks can impact the performance of these digital assets.

The competitive landscape within the crypto and DeFi sectors is dynamic, with many issuers vying for approval to launch similar financial products. The timing of these approvals can be unpredictable, and companies must adapt to ongoing regulatory changes. Investors and stakeholders are advised to closely monitor developments in regulations and market reactions as the DeFi market continues to evolve.

As the integration of gold into DeFi platforms progresses, it may redefine traditional investment strategies. Nevertheless, it remains paramount for participants to weigh both the opportunities and inherent risks associated with these innovative financial products. The future of gold-backed tokens in the DeFi landscape will likely be shaped by ongoing regulatory assessments, technological advancements, and market acceptance.