The Kingdom of Bhutan has made headlines once again as its state-owned entity, Druk Holdings, engages in a pioneering leveraged position with Ethereum (ETH). Recent analysis revealed significant withdrawals totaling 42,000 ETH and $54 million in USDT from Binance to wallets associated with Druk Holdings. This marks a historic moment in the adoption of decentralized finance (DeFi) by a government entity.

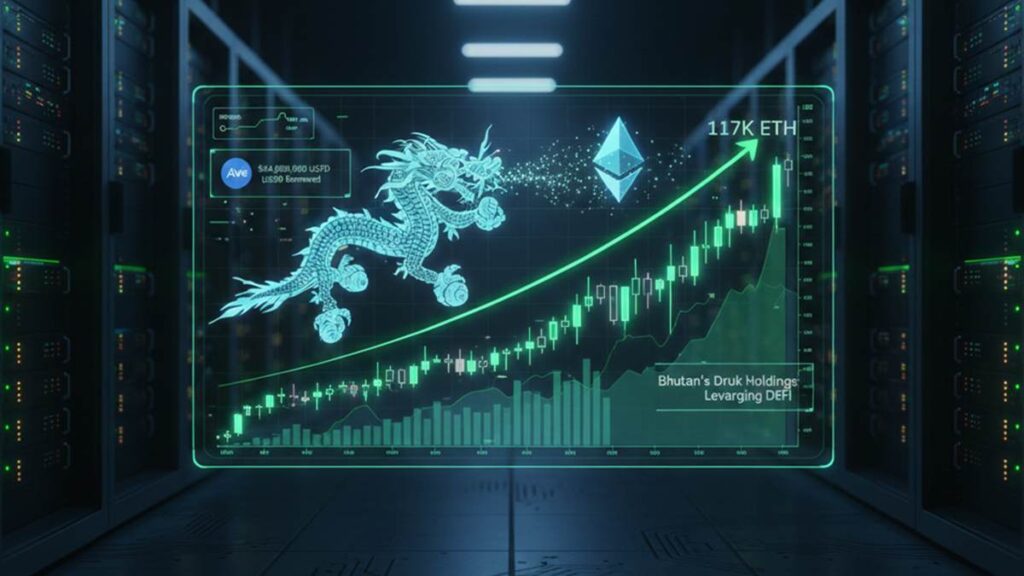

Utilizing the Aave protocol, Druk Holdings has embarked on a strategy that involves depositing Ethereum, borrowing stablecoins, and subsequently acquiring even more digital assets. This approach signifies a shift from traditional asset management to leveraging the DeFi ecosystem for enhanced yield generation. With a total of 117,000 ETH reportedly involved, this strategy positions Bhutan among the first nations to adopt such complex financial maneuvers.

Bhutan”s interest in Ethereum is not a mere coincidence. The country previously launched a national identity system based on the Ethereum network in 2025, under the guidance of Ethereum co-founder Vitalik Buterin. This foundational move underscores Bhutan”s commitment to integrating blockchain technology into its financial infrastructure. The use of protocols like Lido and Aave further solidifies the nation”s intent to harness smart contracts to bolster its national reserves.

However, this ambitious leverage strategy is not without its risks. Current market conditions provide a cushion for this position, yet the liquidation threshold hovers around $1,400 per ETH, necessitating vigilant monitoring of market fluctuations. As such, investors and analysts alike will need to keep a close watch on these developments, as they could set a precedent for other nations considering similar integrations of DeFi liquidity into their sovereign financial strategies.

In summary, Bhutan”s evolution from a focus on Bitcoin mining to sophisticated Ethereum strategies illustrates a remarkable level of financial innovation for a sovereign state. The global crypto community will undoubtedly scrutinize these developments as they unfold, potentially influencing the future of DeFi adoption on a governmental scale.