In a stark revelation for the cryptocurrency sector, Tom Lee, chairman of BitMine Immersion Technologies, has disclosed that the company”s holdings of ether (ETH) have plunged into the red, incurring unrealized losses exceeding $8 billion. This downturn is part of a broader crash affecting the crypto market, which Lee suggests is an intrinsic aspect of its volatility, describing it as “a feature, not a bug.”

Lee, a former strategist at JP Morgan, took the helm at BitMine in June 2025, steering the firm towards a significant investment in ETH. Since the coin”s peak price of $4,946 on August 24, 2025, BitMine has invested over $10.6 billion in acquiring more than 2.76 million ETH. However, in the five months following that high, the price of ETH has plummeted nearly 60%, leading to staggering unrealized losses for the firm.

Overall, BitMine”s total investment in ETH since its strategic pivot amounts to $16.4 billion, yet the company has yet to realize any profits from these ventures. Currently, BitMine controls an impressive 4.29 million ETH, representing just over 3.5% of the total circulating supply of the cryptocurrency.

In response to growing concerns from investors regarding the firm”s substantial losses, Lee reiterated his long-term outlook on ETH, asserting that the intention behind these investments is to “outperform over the cycle.” He also emphasized that the current market conditions, which he labels as a unique crypto winter, differ markedly from previous downturns. Despite lagging prices, he noted a surge in daily transactions, highlighting underlying resilience in the ecosystem.

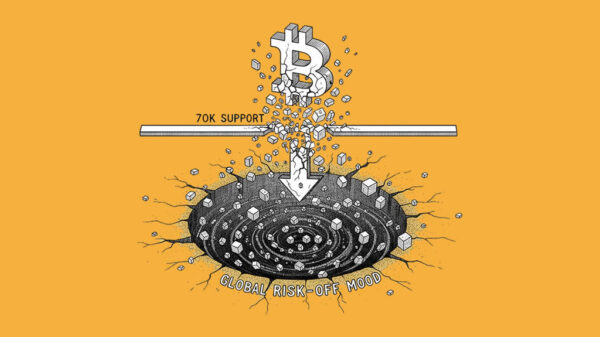

Moreover, Lee pointed to the actions of Binance on October 10 as potentially influencing the subdued price movements seen in recent days. This broader market correction has been significant, with CoinGecko reporting a staggering $820 billion reduction from the overall cryptocurrency market capitalization since January 15, 2025. In the past month alone, ETH has lost $146 billion in market cap, while Bitcoin (BTC) has seen a decline of $490 billion.

The recent downturn serves as a stark reminder that even high-profile endorsements, such as those from the Trump family, can lead to substantial financial losses for investors. For instance, those who purchased ETH following Eric Trump”s endorsement last year would currently face a decline of 31% on their investments.

As the crypto landscape continues to shift, investors and analysts alike will be closely monitoring how firms like BitMine adapt to these challenging market conditions. The resilience of blockchain technology and the potential for recovery in the cryptocurrency markets remain central themes in ongoing discussions among industry stakeholders.