Proprietary trading firms are navigating a complex landscape of marketing strategies across various global markets. One pressing question for these firms is the necessary starting marketing budget and the timeline to achieve break-even profitability. While the United States represents a well-established market for prop trading, Latin America is emerging as a rapidly growing sector with distinct advantages.

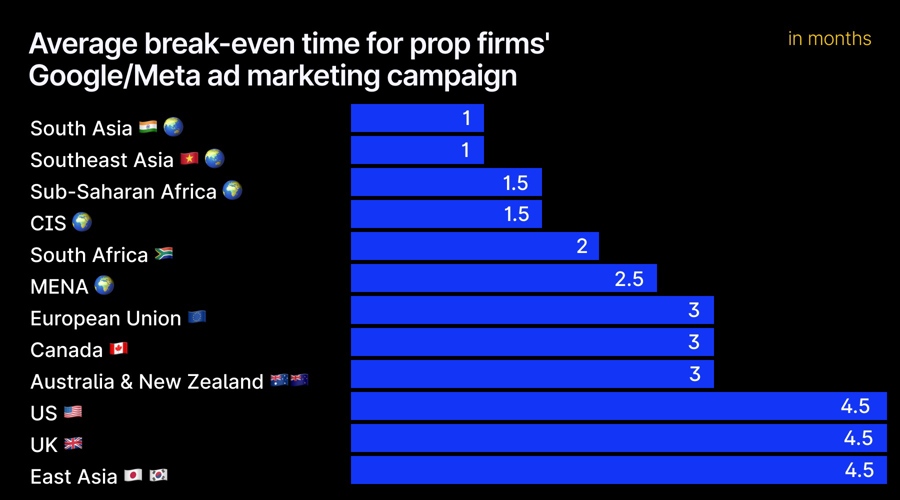

In the US, firms often face a waiting period of three to six months before seeing a return on their marketing investments, particularly when utilizing popular platforms like Google and Meta for advertisements. According to user acquisition consultant Stanislav Galandzovskyi, the initial marketing budget for US firms ranges between $5,000 and over $10,000. Despite the high upfront costs, the potential return on ad spend (ROAS) can reach three times, and in some cases, even quadruple for established brands. This high expenditure is a reflection of the competitive nature of the US market, where firms like Topstep and My Funded Futures dominate.

In contrast, Latin American markets provide a more cost-effective alternative. Here, firms can achieve a positive ROAS within just one to two months, with an initial ad budget requirement of only $1,000 to $2,000 per country. This efficiency makes Latin America an attractive option for prop firms looking to optimize their marketing efforts. Notably, in Brazil, the budget may be slightly higher, ranging from $2,000 to $5,000, yet firms can still target a working ROAS that could reach five times, or even ten times at peak performance. Consumer acquisition costs in these markets generally fall between $30 and $40.

Furthermore, recent studies highlight South America as a leading region for active prop traders, with Colombia leading in participation rates. Meanwhile, prop firms targeting Canadian clients can expect to break even within two to four months with a marketing budget of $3,000 to $6,000, achieving a peak ROAS of around four times.

Other promising markets include India, where firms often reach profitability within the first month, and even neighboring South Asian countries like Pakistan and Bangladesh. The potential for high returns remains stable, with working ROAS between two to four times and peak possibilities reaching twelve times.

As prop firms evaluate their strategies, the comparison between the lucrative but costly US market and the rapidly growing, budget-friendly Latin American markets will be crucial in determining their future investments and operational focus.