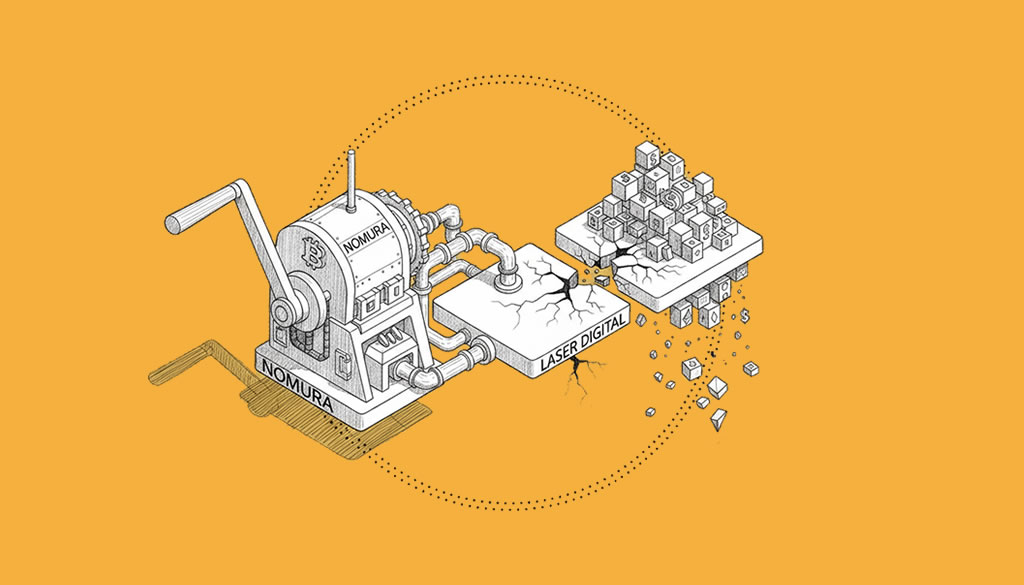

In a significant shift, Japanese financial powerhouse Nomura Holdings is scaling back its exposure to cryptocurrencies following substantial losses reported by its digital asset subsidiary, Laser Digital, during the third quarter of fiscal year 2025. This strategic adjustment comes amidst a backdrop of heightened market volatility that has impacted traditional financial institutions” approaches to digital assets.

Nomura”s decision to tighten risk management protocols is underscored by the subsidiary”s unspecified losses, which have contributed to a larger decline in the firm”s overall financial performance. The company”s net income fell by 9.7% year-over-year, totaling ¥91.6 billion, with European operations notably suffering a loss of ¥10.6 billion. These results did not meet analyst expectations, prompting a 5.3% drop in shares following the earnings announcement.

During an earnings call, Chief Financial Officer Hiroyuki Moriuchi confirmed that the firm has implemented stricter controls on its positions to mitigate the volatility in short-term profits. “We have tightened our management of positions, as well as risk exposure to curb short-term volatility in profit,” Moriuchi stated. Despite the reductions in exposure, he reassured stakeholders of Nomura”s enduring commitment to digital asset ventures and expressed plans for medium- to long-term growth in this sector.

The challenges faced by Laser Digital reflect broader concerns within the cryptocurrency market, particularly regarding price fluctuations and regulatory uncertainties. Analysts highlight the difficulties associated with proprietary trading in high-volatility assets like Bitcoin and Ethereum. Notably, even amidst these setbacks, Laser Digital has recently sought a U.S. operating permit, suggesting that Nomura maintains a strategic interest in the digital asset landscape despite its near-term retrenchment.

This cautious approach mirrors trends observed among other traditional financial institutions as they navigate the complexities and risks associated with cryptocurrencies. The ongoing evolution of the digital asset market continues to prompt organizations like Nomura to reassess their strategies in response to the dynamic regulatory environment and market conditions.