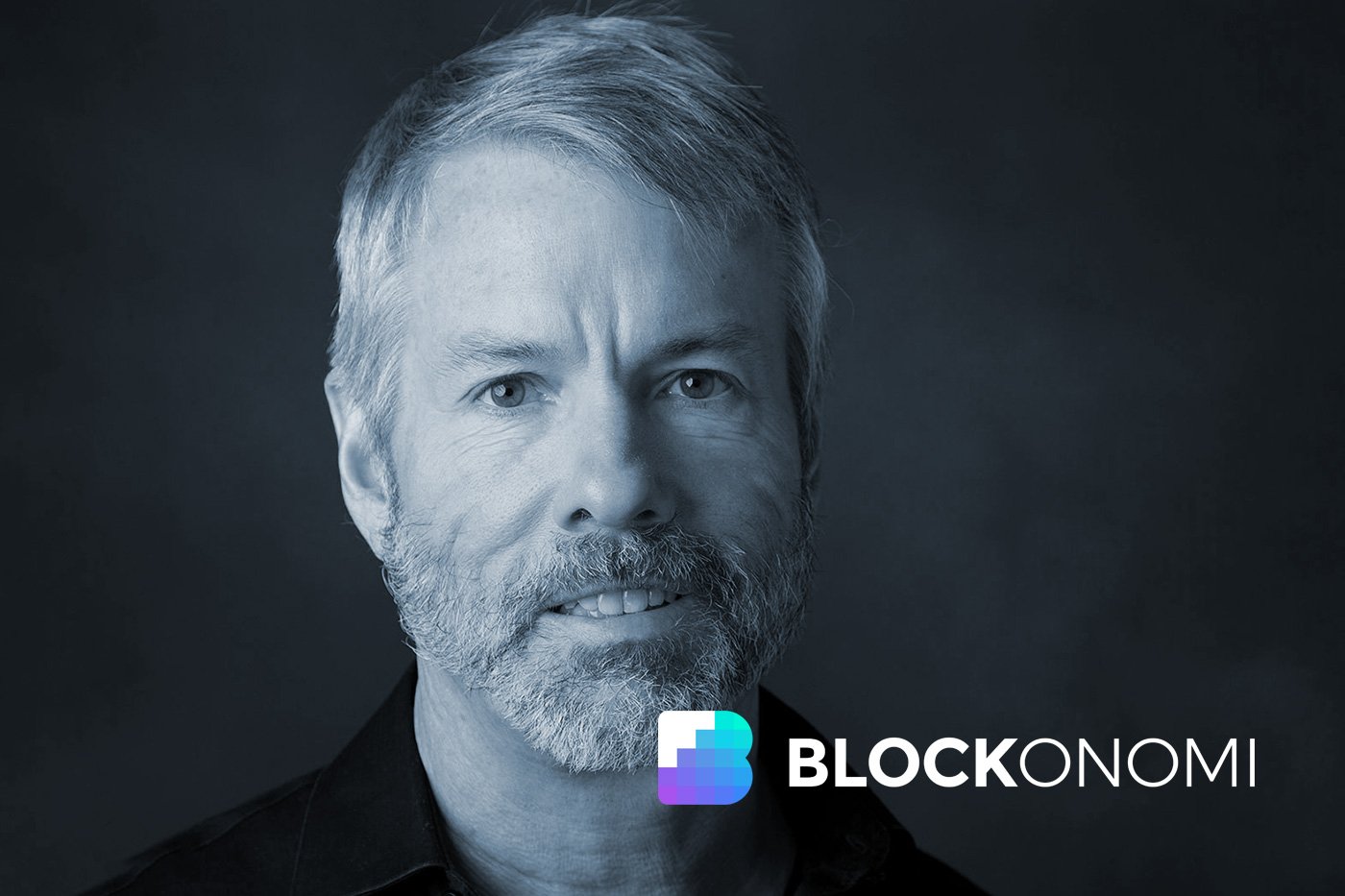

Michael Saylor has launched STRC, a financial product that offers an enticing 11% annual return distributed through monthly cash payments. This initiative is drawing significant attention as it poses a challenge to traditional finance models, particularly in the current economic landscape where traditional fixed-income options are facing scrutiny.

STRC”s structure allows for consistent cash distributions, reportedly backed by a balance sheet capable of covering decades of dividend payouts without the need for future cash flows. This is a notable departure from conventional corporate bonds and other debt instruments that often hinge on refinancing, which can be risky in fluctuating market conditions.

Critics have raised concerns about the sustainability of such high returns, labeling them as potentially too good to be true. However, supporters, including crypto analyst Adam Livingston, argue that skeptics overlook the robust fundamentals supporting STRC”s offering. Livingston recently defended STRC on social media, emphasizing its unique operational model that does not rely on continuous refinancing.

STRC”s monthly cash distributions have sparked a debate among analysts accustomed to traditional risk assessments. The product”s promise of 11% annual returns paid out monthly has led to confusion, particularly as many are trained to view high yields as indicative of high risk.

In his analysis, Livingston compared STRC to government bonds, pointing out that many investors prefer lending to governments that are in perpetual debt while questioning the STRC model. He highlighted the fact that traditional fixed-income investments often depend on central bank policies and consumer confidence for their viability.

Moreover, STRC does not face the refinancing risks that plague corporate bonds, which often require companies to roll over debt under potentially unfavorable conditions. This lack of dependence on future cash flows positions STRC as a distinctive player in the income investment landscape.

In response to the ongoing discussion, Saylor remarked that the success of STRC is intrinsically linked to Bitcoin (BTC). MicroStrategy, the parent company, has amassed significant Bitcoin holdings, connecting its income strategy directly to these assets. By offering yield backed by existing resources rather than speculative projections, STRC is positioning itself as an innovative alternative for investors seeking reliable income streams.

As the market continues to evolve and traditional finance faces challenges, STRC”s approach presents an intriguing option for those seeking to diversify their portfolios with cryptocurrency-backed financial products. The ongoing dialogue about high-yield offerings reflects broader trends in finance, where the lines between traditional and digital assets blur.