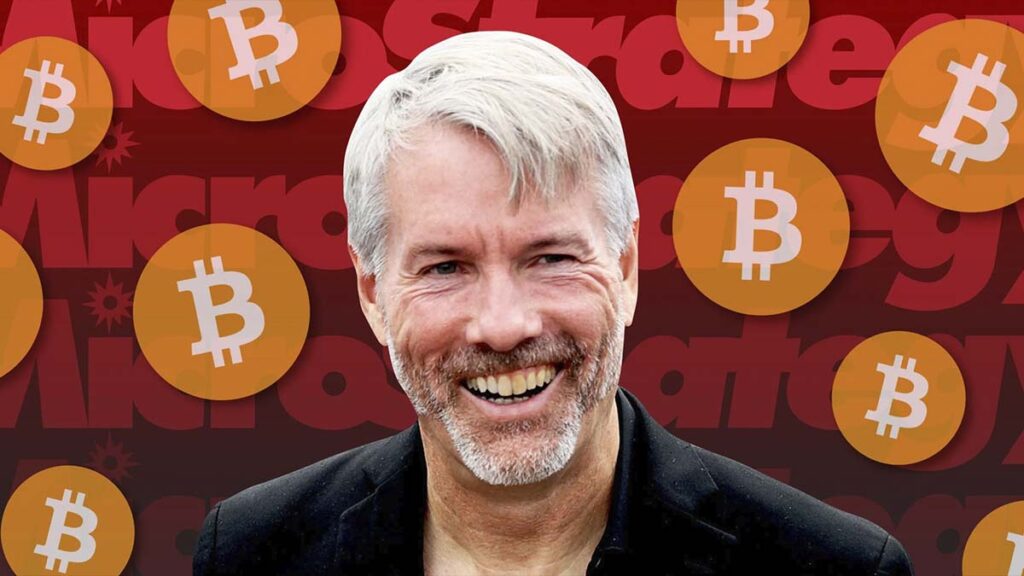

Michael Saylor, the executive chairman of Strategy, has raised eyebrows with a recent social media post that hints at a possible connection with Morgan Stanley. This comes as his Bitcoin-centric company faces scrutiny regarding potential exclusions from major equity indices.

On December 17, Saylor shared an image on X, featuring himself alongside Strategy CEO Phong Le, in front of what appeared to be a Morgan Stanley office. The timing of this post is notable, as concerns mount over whether Strategy”s significant Bitcoin holdings could lead to its removal from prominent equity benchmarks.

During a recent appearance at the Bitcoin MENA conference in Abu Dhabi, Saylor disclosed that Strategy is engaging in discussions with U.S. banks, reflecting a growing institutional interest in Bitcoin-backed financial structures. This is particularly relevant as Strategy currently holds an impressive 671,268 Bitcoin, which is valued at approximately $60 billion, making it the largest corporate holder of Bitcoin in the world.

However, Strategy”s heavy investment in Bitcoin has not been without criticism. The firm has faced backlash due to a significant market downturn that saw Bitcoin”s value plummet from nearly $126,000 to around $90,000 in recent weeks. This volatility has prompted warnings from financial giants like JPMorgan Chase, which cautioned that companies allocating over 50% of their assets to digital currencies might risk being delisted from indices such as the MSCI USA Index, managed by Morgan Stanley Capital International.

In light of these developments, MSCI has confirmed that it is actively reviewing its criteria for index inclusion, and discussions regarding these standards are ongoing. Despite the mounting uncertainty, Strategy has managed to retain its position in the Nasdaq 100 Index, offering a glimmer of stability amid the turbulent market conditions.

As the situation unfolds, the implications of Saylor”s hints at a connection with Morgan Stanley could play a pivotal role in the future trajectory of Strategy and its Bitcoin-heavy strategy.