HashKey Holdings has achieved a significant milestone by obtaining listing approval from the Hong Kong Stock Exchange (HKEX). This development positions HashKey to potentially execute Hong Kong”s inaugural public offering focused on the cryptocurrency sector, with plans to raise up to $500 million through the initial public offering (IPO).

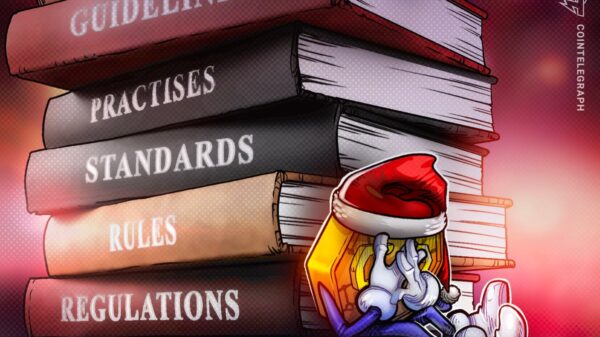

The approval, which was disclosed on December 1, 2025, represents a pivotal moment for HashKey as it progresses towards an IPO that may occur before the end of the year. This event marks a critical advancement for Hong Kong”s regulated cryptocurrency landscape, as HashKey is recognized as one of the leading licensed virtual asset service providers in the region.

Operating under Hong Kong”s stringent regulatory environment, HashKey offers a comprehensive ecosystem that includes digital asset trading, custody, asset management solutions, and staking services, catering to both retail and institutional investors. The anticipated listing on HKEX could serve as a benchmark, indicating how traditional capital markets may engage with licensed cryptocurrency enterprises operating on a larger scale.

Funding for Global Expansion

While HashKey has not finalized a specific date for the listing, internal estimates suggest that the IPO could take place before the end of 2025. The company aims to utilize the funds raised to enhance its international outreach, upgrade trading and compliance systems, and expand its array of investment products. Executives view this IPO as a strategic maneuver that could solidify HashKey”s standing in global markets, especially as the demand for regulated digital asset platforms continues to surge.

Challenges and Market Sentiment

Despite generating HK$721 million in revenue in 2024, HashKey has not reached profitability, reporting a net loss of HK$506 million in the first half of 2025. This financial performance is attributed to aggressive investments aimed at fostering growth in a maturing market. Analysts indicate that while regulated exchanges often incur substantial upfront costs, long-term profitability typically improves as trading volumes and custodied assets increase.

HashKey”s forthcoming IPO acts as a significant test for investor appetite within the Asian capital markets. A successful listing could validate Hong Kong”s regulatory framework for digital assets, demonstrating strong institutional interest in crypto-related equities. Market analysts suggest that HashKey”s entry into public markets may also encourage other licensed platforms to pursue similar paths, thereby reinforcing Hong Kong”s ambition to establish itself as a global hub for Web3 financial services.

In summary, HashKey”s recent approval from HKEX marks a crucial step towards becoming the first publicly listed cryptocurrency infrastructure company in Hong Kong, potentially setting the stage for one of the largest digital asset IPOs in Asia”s history.