Harvard University has made a substantial move in the cryptocurrency space by increasing its holdings in Bitcoin exchange-traded funds (ETFs) by 257%, as revealed in a recent filing. This decision comes even as the fund faces unprecedented investor withdrawals.

According to the filing, Harvard now owns 6.81 million shares of BlackRock”s spot Bitcoin ETF, known as IBIT, which was valued at $442.8 million as of September 30. This marks a significant increase from its previous holdings of 1.9 million shares in June. In addition, the university has almost doubled its exposure to gold-backed ETFs, reporting 661,391 shares of GLD valued at $235 million, a remarkable 99% increase from its earlier position.

While many retail investors are reeling from recent price declines, Harvard appears to be taking a long-term view on the potential of Bitcoin. This shift is particularly noteworthy given the skepticism expressed by some Harvard economists in the past. Back in 2018, one economist predicted that Bitcoin was more likely to plunge to $100 than to reach $100,000 by 2028. Contrary to that forecast, Bitcoin has surged to as high as $120,000 well ahead of the predicted timeline.

Harvard”s investment now places it among the top 30 institutional holders of IBIT. Bloomberg analyst Eric Balchunas noted that endowments typically shy away from investing through ETF structures, making Harvard”s allocation a significant signal to other institutions.

Another institution, Al Warda Investments, has also increased its Bitcoin fund holdings, raising its position to 7.96 million IBIT shares worth $517.6 million, a 230% increase since June.

Despite these institutional investments, the broader ETF market is experiencing a trend of withdrawals. Data from SoSoValue indicates that Bitcoin products have seen three consecutive days of outflows, with an additional $492 million withdrawn during trading yesterday alone. On Thursday, the Bitcoin fund recorded outflows of $869.9 million, marking the second-largest outflow since its launch.

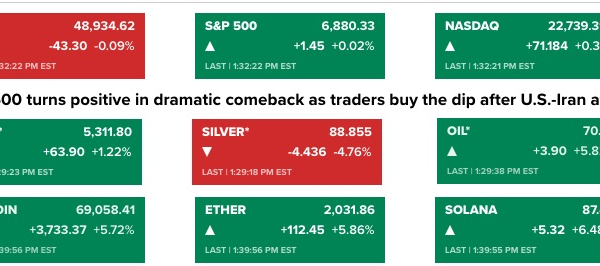

This ongoing withdrawal trend is impacting Bitcoin”s price, which has dropped by 1.24% in the last 24 hours to $96,261. It briefly fell to around $95,000 before stabilizing. Nevertheless, the overall sentiment remains bullish according to certain metrics. Since the beginning of 2024, Bitcoin ETFs have accumulated over $60 billion in net inflows, with trading volume surpassing $1.5 trillion. BlackRock”s IBIT now commands over half of the U.S. Bitcoin fund market.

In a broader context, Ethereum funds are also experiencing heavy outflows, while only the Solana ETF and XRP ETF seem to be attracting new investments.