In a striking example of lost potential within the cryptocurrency realm, the failed exchange FTX could have substantially mitigated its bankruptcy woes had it held onto its stake in the AI startup Anthropic. Initially investing $500 million in 2021, FTX”s 8% ownership would now be worth approximately $30 billion following Anthropic”s recent valuation surge.

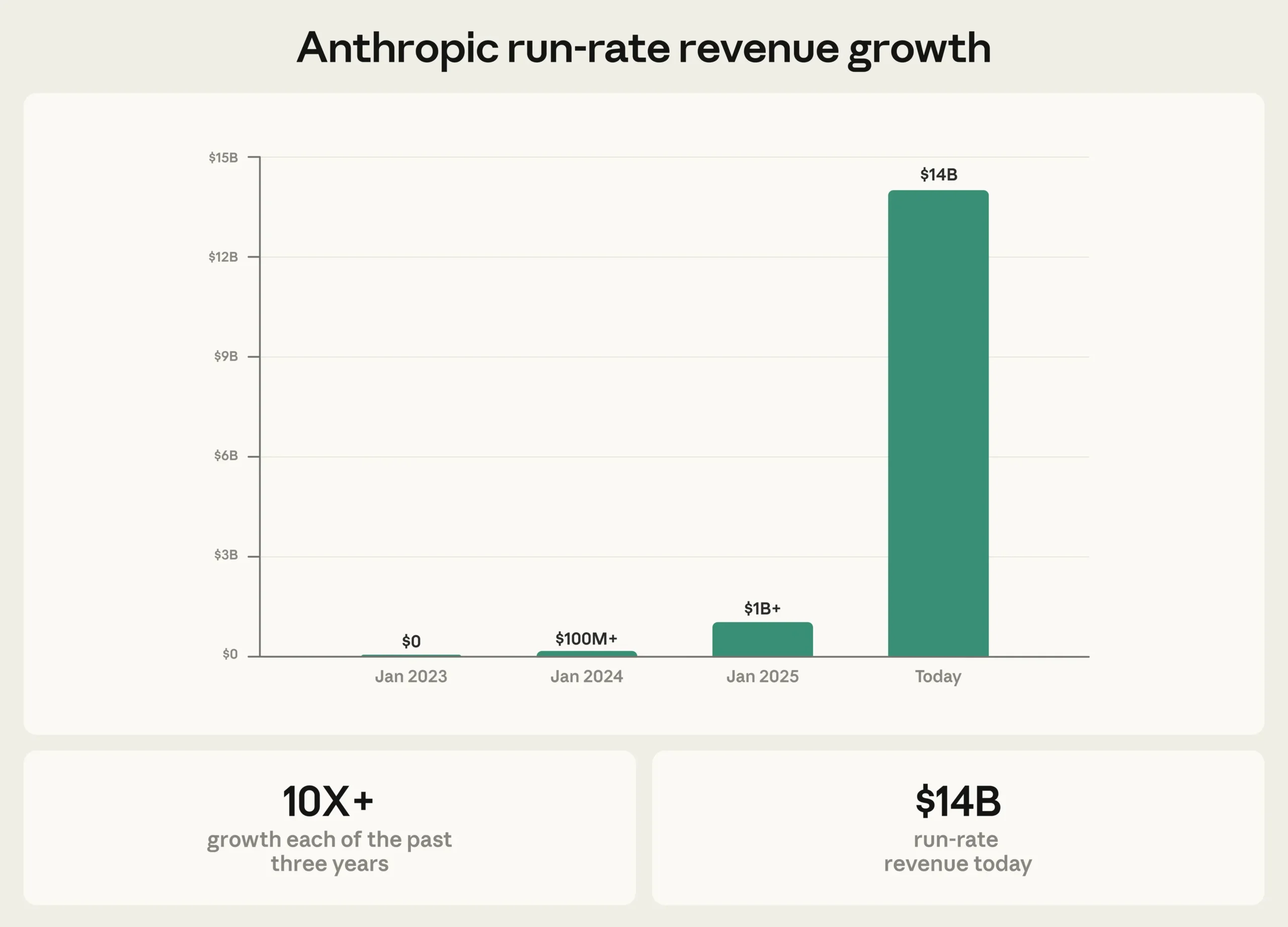

The significant transformation of Anthropic”s worth underscores the dramatic rise of the AI sector. The company recently secured a staggering $30 billion in a Series G funding round, raising its post-money valuation to $380 billion. This funding round, led by Singapore”s sovereign wealth fund GIC and Coatue Management, marks one of the largest private software financing rounds ever.

During its bankruptcy proceedings, FTX was compelled to sell its Anthropic stake in phases. By early 2024, the exchange had offloaded the bulk of its holdings for between $1.3 billion and $1.5 billion, a decision made at a time when Anthropic”s valuation hovered around $18 billion. The timing of this sale proved to be a critical miscalculation, as retaining its investment could have more than tripled FTX”s $9 billion shortfall.

As the cryptocurrency community reflects on FTX”s downfall, the implications of this case extend beyond its immediate financial impact. Sam Bankman-Fried, the face of FTX, is now serving a 25-year sentence for fraud. His story serves as a cautionary tale within both crypto and venture capital circles, illustrating the repercussions of mismanagement and the unfortunate timing of forced asset sales.

For FTX”s creditors, who have managed to recoup billions through other asset liquidations, the missed opportunity presented by Anthropic remains a painful reminder of what could have been. An industry observer aptly noted that this scenario exemplifies how market timing, regulatory pressures, and rapid growth cycles can turn a promising investment into a costly oversight.

The narrative surrounding FTX and Anthropic highlights the harsh realities of navigating financial distress within fast-evolving technology sectors. The unrealized gains of nearly $29 billion symbolize a profound loss, one that could have significantly altered the aftermath of FTX”s collapse. Instead, it stands as a stark reminder of opportunity lost forever.

As the AI landscape continues to expand, Anthropic”s rise positions it as a formidable competitor in the market, challenging other major players like OpenAI. The developments serve as a testament to the unpredictable nature of investments in the tech sphere, especially within the volatile cryptocurrency sector.