Chainlink has officially become a member of the Global Alliance for KRW Stablecoin (GAKS), a significant initiative spearheaded by the South Korean blockchain and gaming firm WEMADE. This alliance aims to advance the standards and adoption of Korean-won-backed stablecoins.

The inclusion of Chainlink in GAKS marks a notable development, as it adds a robust oracle network to the alliance”s framework. This partnership is expected to enhance the technical capabilities surrounding KRW stablecoins by leveraging Chainlink“s expertise in data interoperability, compliance, and privacy standards.

Since its inception in November 2025, GAKS has sought to ensure that KRW stablecoins adhere to both local regulatory guidelines and international technical standards. The alliance encompasses a wide range of participants, including security firms, fintech innovators, and blockchain infrastructure developers.

By joining GAKS, Chainlink positions itself as a crucial player in establishing the global technical standards for KRW stablecoins, utilizing its oracle technology to bridge blockchain networks with real-time, reliable data. This capability is essential for the transparency and compliance needed for institutional acceptance of KRW-backed digital assets.

Furthermore, Chainlink lends institutional credibility to GAKS, as its oracle solutions are already trusted by major entities like UBS, Mastercard, and Fidelity International. This association indicates that KRW stablecoins developed within this framework will meet high regulatory and security standards.

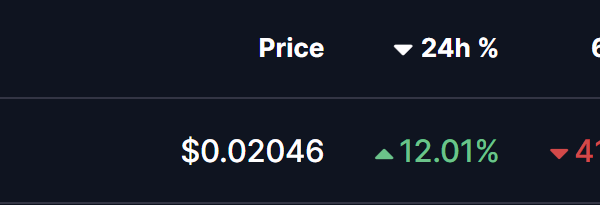

The partnership has already yielded a positive response in the market, with LINK experiencing a modest price increase of over 1% within 24 hours of the announcement, slightly outperforming the broader cryptocurrency market. This uptick reflects a convergence of fundamental and technical factors, reinforcing LINK“s utility in South Korea”s regulated stablecoin sector.

Chainlink“s involvement in GAKS signals to investors that its technology is integral to a growing and compliant market, a factor likely to bolster long-term demand for LINK. On-chain metrics reveal significant accumulation by large holders, who are withdrawing LINK from exchanges, suggesting a value opportunity perceived by informed investors.

From a technical standpoint, LINK was approaching oversold conditions, with the Relative Strength Index (RSI) dipping to 38.95, while the price tested the support range of $11.38 to $11.92. Although the current situation indicates potential for a short-term rebound, broader market indicators remain cautious, as LINK trades below critical moving averages, including the 200-day Simple Moving Average situated around $16.056. A more substantial recovery appears contingent on breaking above the $13.40 level.

Overall, while the GAKS partnership may provide a temporary boost to LINK“s price and technical momentum, the overarching market trend remains bearish. Sustained upward movement will likely depend on continuous institutional adoption, further technical integrations, and favorable developments across the market.