Bullish has reported a staggering net loss of $563.6 million for the fourth quarter on a GAAP basis, a figure that reflects the challenges faced by the cryptocurrency sector amid macroeconomic pressures. Despite this significant loss, the company managed to exceed analyst expectations with adjusted revenues of $92.5 million, which surpassed the forecast of $87.8 million. Additionally, adjusted earnings per share (EPS) came in at $0.19, beating the anticipated $0.15.

The substantial fourth-quarter loss was largely attributed to non-cash digital asset losses and the inherent volatility in the cryptocurrency markets. Tom Farley, CEO of Bullish, expressed his unwavering confidence in the company”s strategic positioning, stating, “We are more convicted than ever that our institutional positioning is the right approach.” He further highlighted the optimistic outlook for 2026, asserting that the company is poised to thrive despite existing challenges.

In September, Bullish launched spot cryptocurrency trading in the United States, entering a highly competitive and regulated environment. During the fourth quarter, the platform processed an impressive $64.3 billion in spot trading volume, primarily driven by institutional interest. Furthermore, the company expanded its offerings by introducing an options trading division, which accounted for $9 billion in options volume during the same period.

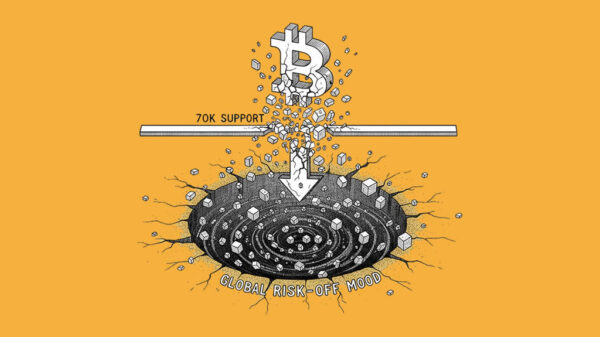

Despite these operational expansions, Bullish”s shares fell 5% in reaction to broader market pressures and a notable decline in the prices of digital assets, including a more than 7% drop in the price of Bitcoin following the earnings announcement.

As analysts evaluate the company”s performance, there are mixed signals regarding its future. Ed Engel, an analyst at Compass Point, acknowledged Bullish”s strong performance in Q4 but pointed out that early data for 2025 indicated a slowdown in trading activity. Revenue in January showed a 17% month-over-month decline, coming in 32% lower than the Q4 average, raising concerns about the company”s near-term visibility.

Engel maintained a Neutral rating on Bullish”s stock and placed a $35 price target under review, citing uncertainties surrounding cryptocurrency valuations. On a more optimistic note, Owen Lau from Oppenheimer noted that revenue from subscriptions, services, and other facets showed potential for nearly 50% growth at the midpoint, indicating some stability.

Bullish transitioned into the public market through a direct listing on the New York Stock Exchange in August, having previously functioned as a private exchange catering to institutional clients. As the company navigates a tumultuous market landscape, its focus on expanding trading options and institutional engagement may prove crucial for its long-term success.