In a significant move emphasizing economic independence, Russian President Vladimir Putin is currently in India for discussions with Prime Minister Narendra Modi. This two-day visit marks a pivotal moment as both nations, part of the BRICS bloc, are actively transitioning away from the US dollar for trade settlements.

During his visit, Putin announced that over 90% of trade transactions between Russia and India are now being conducted in their respective local currencies—the Russian ruble and the Indian rupee. This shift represents a concerted effort by both countries to minimize dollar reliance in cross-border trade.

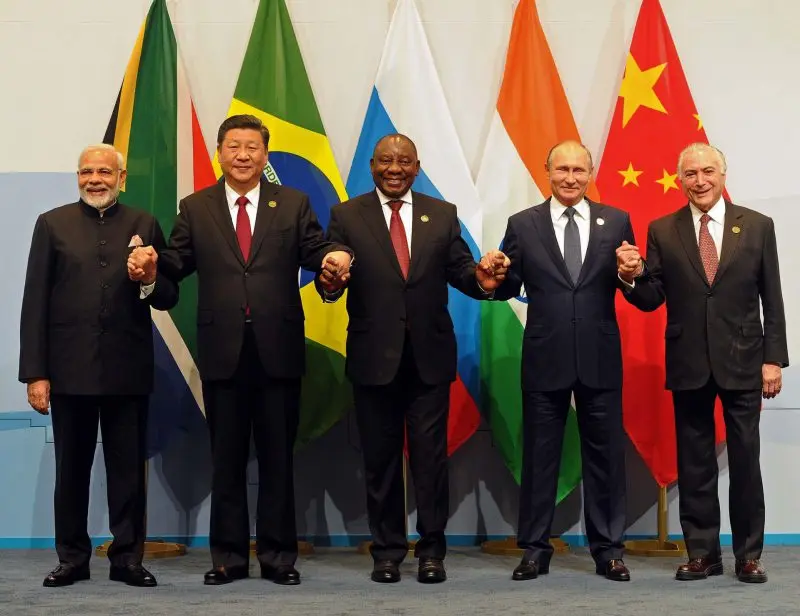

The decision to conduct trade in local currencies comes amid a global trend towards a multipolar financial landscape. As BRICS nations seek to establish their own economic frameworks, the diminishing role of the US dollar is becoming increasingly evident. The ongoing geopolitical tensions and trade tariffs, especially those initiated during the Trump administration, have catalyzed this collaboration among developing nations.

By leveraging local currencies, Russia and India aim to stabilize their economies and enhance trade efficiency. This strategy not only reduces exposure to dollar-related inflation but also fosters stronger economic ties between BRICS members. The implications of this shift are profound, potentially reshaping the dynamics of global trade and posing a challenge to the dominance of the US dollar.

While there is currently no official BRICS currency in circulation, the move towards local currency settlements is a clear indicator of the bloc”s intentions to create a sustainable and resilient economic environment. The ongoing discussions between Russia and India will likely pave the way for further agreements, reinforcing their commitment to a collaborative economic future.

As BRICS nations continue to explore alternative financial systems, the implications for global trade and the US economy will be closely monitored. This ongoing transition not only reflects the aspirations of these nations but also highlights the shifting tides in international commerce.