BNP Paribas, the largest bank in Europe with over $3 trillion in assets, has implemented a tokenized share class for a French-domiciled money market fund on the public Ethereum blockchain. This initiative represents a noteworthy advancement in the ongoing transition of traditional finance towards distributed ledger technology.

The pilot project, carried out via the bank”s AssetFoundry platform, serves as a testing ground for the integration of public blockchains within highly regulated fund structures. Despite this innovative approach, BNP Paribas has opted to retain strict control over the digital assets involved.

The tokenized shares operate under a permissioned access model, which means that both holdings and transfers are cryptographically limited to a whitelist of authorized participants who comply with rigorous standards. The bank stated, “The initiative was conducted as a one‐off, limited intra‐group experiment, enabling BNP Paribas to test new end‐to‐end processes, from issuance and transfer agency to tokenization and public blockchain connectivity, within a controlled and regulated framework.”

This “walled-garden” strategy indicates a growing consensus among institutional asset managers who wish to leverage the settlement infrastructure of public networks like Ethereum while still adhering to the stringent access protocols characteristic of traditional financial systems.

Notably, this project follows a previous pilot conducted by BNP Paribas that utilized a private blockchain in Luxembourg. This shift suggests a cautious but clear institutional movement towards public networks in pursuit of enhanced interoperability for the future.

Money market funds are increasingly recognized as a primary platform for testing blockchain initiatives within Wall Street”s ambitions. For institutional investors, the tokenization of these funds offers a regulated, yield-bearing alternative to fiat-backed stablecoins. Additionally, traditional fund processing often relies on slower, batch-based settlement systems that can impede capital flow. Tokenization has the potential to facilitate atomic, nearly instantaneous settlements, thus significantly enhancing capital efficiency.

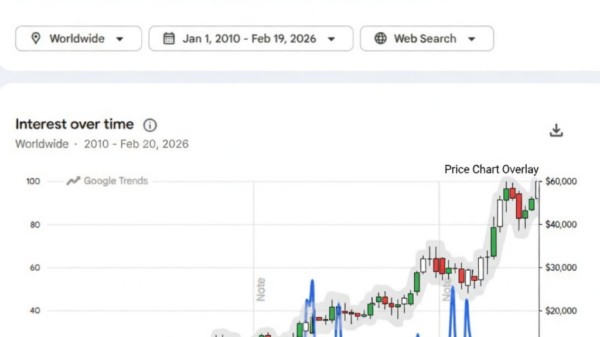

As BNP Paribas enters this competitive arena, it joins prominent players such as BlackRock, JPMorgan Chase & Co., and Fidelity Investments, all of which have made strides in deploying tokenized money market funds on Ethereum. Current data from Token Terminal indicates that Ethereum leads the tokenized asset market, including segments such as stablecoins, commodities, and tokenized funds. The total market capitalization of real-world assets within the Ethereum ecosystem, excluding stablecoins, has recently surged past $15 billion, reflecting a year-over-year increase of approximately 200%.