Bitcoin exchange-traded funds (ETFs) garnered notable attention recently, attracting $88.04 million in net inflows on February 20. This surge highlights the ongoing institutional interest in Bitcoin, contrasting sharply with the anemic performance of Ethereum ETFs, which struggled to secure new capital.

The inflows for Bitcoin ETFs were largely driven by BlackRock”s IBIT, which alone absorbed $64.46 million, representing approximately 73% of the total daily inflow. Additionally, Fidelity Investments”s FBTC contributed $23.59 million to this momentum, while other Bitcoin funds remained stagnant.

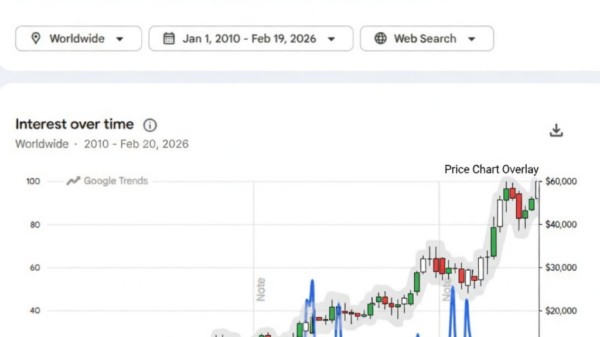

As of now, IBIT has amassed cumulative net inflows totaling $61.30 billion, a clear testament to its commanding presence in the Bitcoin ETF landscape. In the latter half of last year, Bitcoin investment vehicles experienced a period of robust growth, with inflows peaking between $5 billion and $8 billion. However, a significant shift occurred in November, leading to substantial outflows that persisted into the following months. Current data indicates that while assets under management remain close to historical highs, growth has notably decelerated.

In stark contrast, the picture for Ethereum ETFs is less favorable. On the same day that Bitcoin funds saw substantial inflows, Ethereum spot ETFs only managed to attract a mere $17,210. BlackRock”s ETHA saw a modest inflow of $1.78 million, but this was overshadowed by a $2.45 million outflow from Fidelity”s FETH. Other products in the Ethereum space, including 21Shares”s TETH, reported minimal gains, further illustrating the lack of demand.

Despite ETHA”s cumulative net inflows totaling $11.88 billion, Grayscale Investments”s ETHE continues to reflect a historical net outflow of $5.19 billion, indicating a persistent trend of capital moving away from older fund structures. The volatility of Ethereum flows is also striking; for instance, January 30 recorded outflows of $252.9 million, with additional significant redemptions noted in mid-February.

The disparity in institutional adoption between Bitcoin and Ethereum is becoming increasingly pronounced. While Bitcoin consistently attracts a more stable institutional base, Ethereum”s inflows are significantly more reactive to short-term price fluctuations and broader market news. Recent data suggests that while both assets have seen a cooling in momentum, Ethereum remains notably more volatile.

The recent inflows into Bitcoin products serve as a clear indicator of ongoing institutional risk appetite, confirming that capital is entering Bitcoin ETFs in substantial amounts. Conversely, the thin demand for Ethereum products raises concerns about its ability to maintain competitive institutional interest without a sustained period of accumulation.