U.S. spot Bitcoin exchange-traded funds (ETFs) have demonstrated resilience this week, attracting significant inflows that almost negate the losses experienced the previous week, despite continued pressure on Bitcoin prices. On Tuesday, these ETFs registered net inflows of $166.6 million, bringing the weekly total to $311.6 million, as reported by SoSoValue.

This recovery follows a challenging week where the ETFs faced $318 million in net outflows, marking the third consecutive week of declines and contributing to cumulative losses exceeding $3 billion over the last three weeks. The resurgence in inflows comes in the face of a 13% drop in Bitcoin prices over the past week, which saw the cryptocurrency briefly dip below $68,000, according to data from CoinGecko.

Analysts have noted signs indicating a potential turning point for crypto exchange-traded products, citing a reduction in selling pressure along with more stable fund flows. This shift suggests that investor sentiment towards ETFs may be stabilizing, even as the wider market experiences volatility.

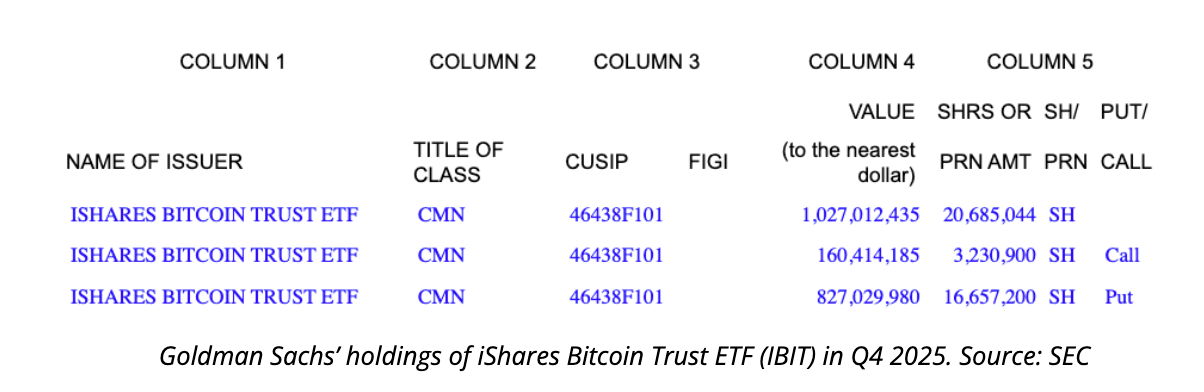

Institutional strategies are also evolving. Goldman Sachs recently filed a Form 13F with the U.S. Securities and Exchange Commission, revealing a reduction in its exposure to Bitcoin ETFs during the fourth quarter of 2025. The financial institution decreased its holdings in BlackRock”s iShares Bitcoin Trust (IBIT) by 39%, dropping the number of shares outstanding from approximately 34 million in Q3 to 20.7 million in Q4, with a valuation near $1 billion. Additionally, Goldman trimmed its positions in other Bitcoin-linked products, including Fidelity”s Wise Origin Bitcoin Fund (FBTC) and various Ether ETFs.

Conversely, Goldman Sachs has established new positions in XRP and Solana ETFs, acquiring 6.95 million shares of the XRP ETF valued at $152 million and 8.24 million shares of the Solana ETF worth $104 million. Data from SoSoValue indicates that spot altcoin ETFs also experienced modest inflows on Tuesday, with Ether funds gaining approximately $14 million and XRP and Solana ETFs increasing by $3.3 million and $8.4 million, respectively.

Despite the recent fluctuations in the market, long-term ETF investors have largely maintained their positions. Eric Balchunas, a senior ETF analyst at Bloomberg, noted that only around 6% of total Bitcoin ETF assets have left during this downturn. While IBIT”s assets have decreased from a peak of nearly $100 billion to approximately $60 billion, it remains the fastest ETF to reach the $60 billion mark in assets.