On February 20, Bitcoin exchange-traded funds (ETFs) experienced a substantial inflow of $88.04 million, demonstrating ongoing institutional interest. In stark contrast, Ethereum products struggled to attract new capital, recording a mere $17,210 in net inflows.

The inflow data reveals that demand remains concentrated among a select few issuers, with BlackRock”s IBIT leading the charge by securing $64.46 million, which constitutes approximately 73% of the daily total. Fidelity Investments also contributed with its FBTC product, adding $23.59 million. Meanwhile, other Bitcoin funds reported no significant changes.

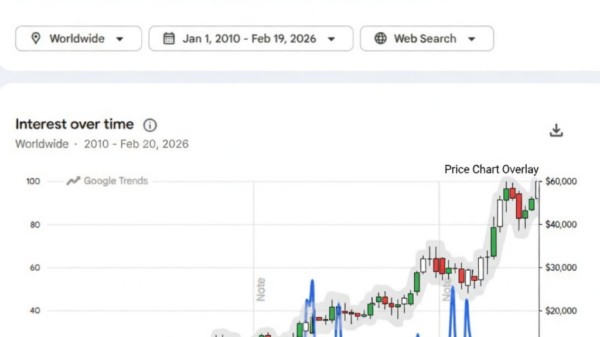

IBIT now boasts cumulative net inflows of $61.30 billion, solidifying its position as the leading player in the Bitcoin ETF space, with no other product coming close to this scale. This marks a pronounced shift from the previous year when Bitcoin investment vehicles enjoyed several months of robust inflows, ranging from $5 billion to $8 billion. However, a notable downturn began in November, leading to a continued decline over the subsequent months.

As for Ethereum, the situation is markedly different. The total net inflows for its ETFs on the same day reached only $17,210, a fraction of Bitcoin”s strong performance. BlackRock”s ETHA managed to secure $1.78 million, while Fidelity”s FETH faced an outflow of $2.45 million. The TETH product from 21Shares saw a minor increase of $687,000, but overall, the sector remains stagnant.

Notably, ETHA”s total net inflows currently stand at $11.88 billion. However, Grayscale Investments” ETHE has recorded a historical net outflow of $5.19 billion, highlighting a continued trend of capital moving away from older investment structures.

Daily data indicates that Ethereum flows are characterized by heightened volatility, with significant outflows observed on January 30, totaling $252.9 million. Additional significant redemptions occurred on February 11 and 12, with $129.2 million and $113.1 million exiting, respectively, and another $130.2 million on February 19. Despite occasional rebounds near the $50 million mark, these fluctuations underline the instability in the Ethereum ETF market.

In summary, while Bitcoin continues to consolidate its institutional lead, Ethereum is grappling with a lack of depth in its flows. The disparity in demand suggests that without a sustained trend of accumulation in Ethereum funds, the gap in institutional adoption between Bitcoin and Ethereum may continue to widen.