In a notable advancement for institutional involvement in decentralized finance (DeFi), Apollo Global Management Inc. has formed a partnership with the DeFi lending platform Morpho. This collaboration was revealed last Friday by the Morpho Association, indicating Apollo”s intention to secure a substantial stake in the platform while also bolstering its blockchain-based lending infrastructure.

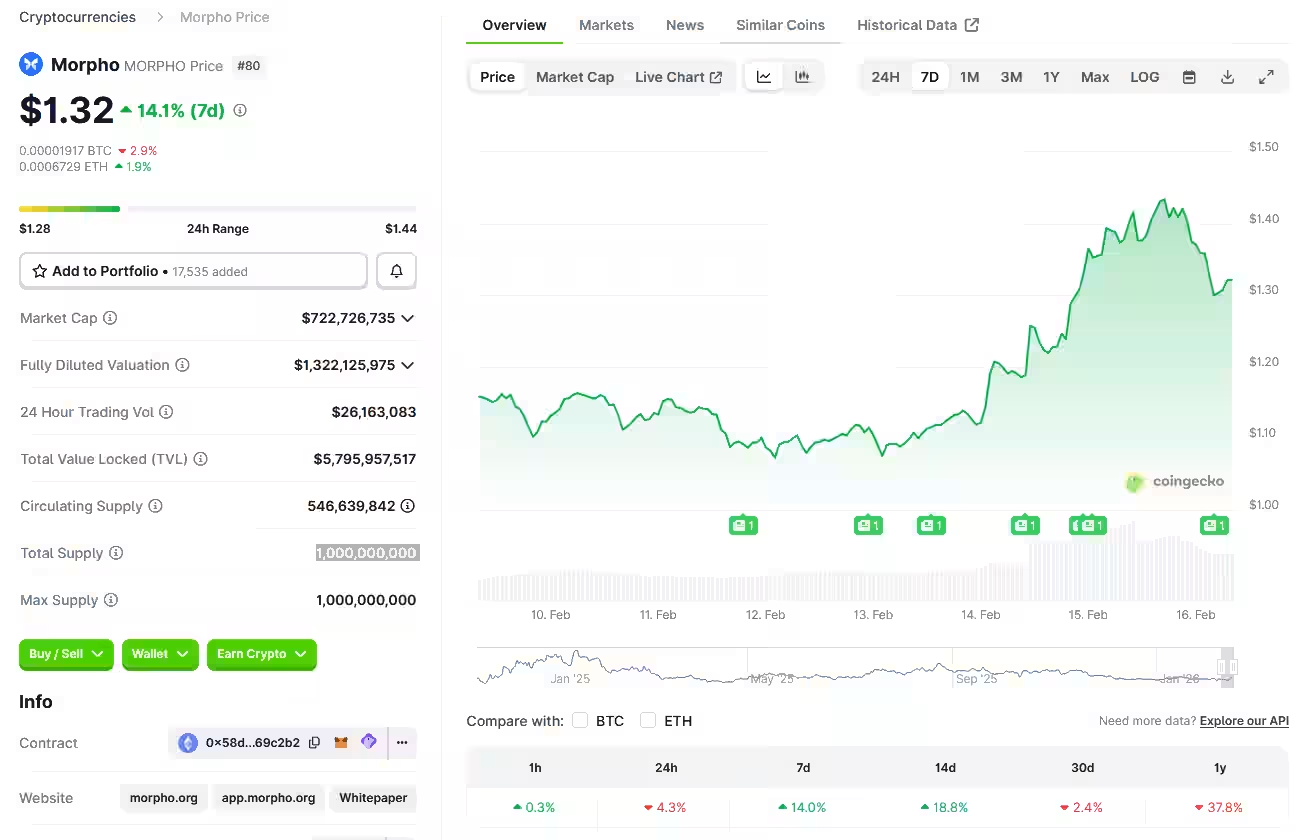

The partnership is structured as a “cooperation agreement,” allowing Apollo and its affiliates to acquire up to 90 million MORPHO governance tokens over a four-year timeframe. This acquisition represents 9% of the total supply of 1 billion tokens, making it a significant investment from a single institutional player.

According to details from the Morpho Association, the token acquisition might occur through various channels, including open-market purchases and over-the-counter transactions. There will be ownership caps and trading restrictions in place, ensuring a controlled and gradual investment process over the specified 48 months. Beyond the token acquisition, both parties will collaborate to enhance the on-chain lending markets within Morpho”s protocol.

The announcement had an immediate impact on the market, with MORPHO experiencing a surge of approximately 17.8%, climbing from $1.12 on Friday to $1.32. Despite this increase, the token has faced challenges over the past year, showing a 38% decline amid broader market difficulties. Currently, Morpho is recognized as the sixth-largest DeFi protocol, boasting around $5.8 billion in total value locked, as reported by DeFi Llama.

Apollo”s interest in Morpho aligns with a growing trend of institutional players entering the DeFi space. Recently, digital asset manager Bitwise announced its participation in offering curated vaults on the platform, promising a 6% annual yield. Additionally, last week, Bitcoin-focused DeFi project Lombard selected Morpho as an initial liquidity partner for its new Bitcoin Smart Accounts, further highlighting the momentum behind Morpho.

Apollo Global Management has been steadily increasing its presence in the cryptocurrency sector. Notably, in 2025, the firm collaborated with Coinbase to develop stablecoin credit strategies and invested in Plume, a platform dedicated to tokenizing real-world assets. The partnership with Morpho is the latest instance of Apollo merging traditional financial practices with decentralized technologies.

Moving forward, both investors and industry analysts will closely observe how Apollo and Morpho implement their plans to support on-chain lending markets. Key questions remain regarding whether this partnership will lead to additional institutional products, such as tokenized credit lines or specialized vaults, and how Apollo”s involvement might shape Morpho”s governance and strategic path. Market participants will also be attentive to MORPHO“s price trends and adoption metrics, especially as further institutional backing could spark increased interest in the protocol.