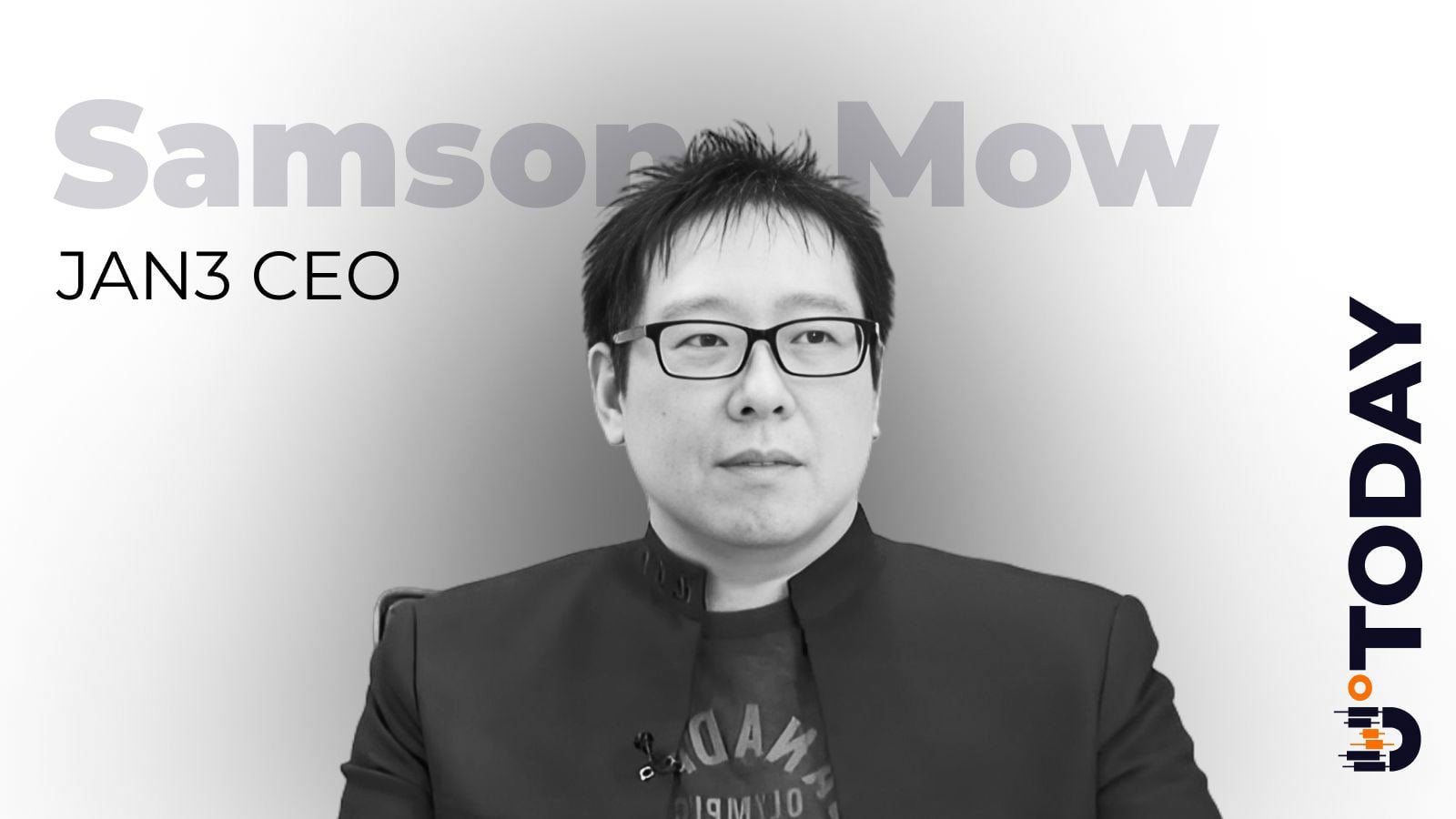

On January 3, Samson Mow ignited a significant discussion within the cryptocurrency community by emphasizing the fundamental differences between the scarcity of Bitcoin and that of gold, which may soon face new challenges. Mow, a notable advocate for Bitcoin, asserted that Bitcoin”s supply is capped at 21 million coins, making it impossible to create or convert anything into this digital asset.

Mow”s comments were sparked by recent developments from Marathon Fusion, where scientists announced they had successfully developed a scalable technique to transmute mercury into gold. This breakthrough could potentially allow future fusion power plants to generate approximately two metric tons of gold per gigawatt of thermal energy annually. The researchers also noted that this innovative gold production method does not compromise electricity output and has the potential to significantly increase the revenue of fusion facilities.

The long-standing perception of gold”s value has been closely tied to its natural scarcity and the challenges associated with its extraction. However, this may be about to change. If the transmutation process is implemented widely, gold”s availability could become more of a manufactured commodity than a naturally limited resource. This shift could lead to a devaluation of gold compared to Bitcoin, which maintains its status as a digital asset with a fixed supply.

In light of this research, Mow”s statements reignited the ongoing debate surrounding the comparative value and scarcity of Bitcoin versus gold. The cryptocurrency community has consistently recognized that Bitcoin”s supply is hard-capped at 21 million coins, further solidified by the fact that its digital nature renders it impossible to replicate. In contrast, gold”s supply may soon be augmented due to advancements in nuclear science.

Despite Bitcoin being mined, its total supply remains immutable at 21 million tokens. Consequently, no scientific discovery, laboratory experiment, or technological advancement can alter this limit. Observers in the crypto space have reiterated that Bitcoin”s value is underpinned by mathematical principles and global consensus rather than geological or chemical factors.