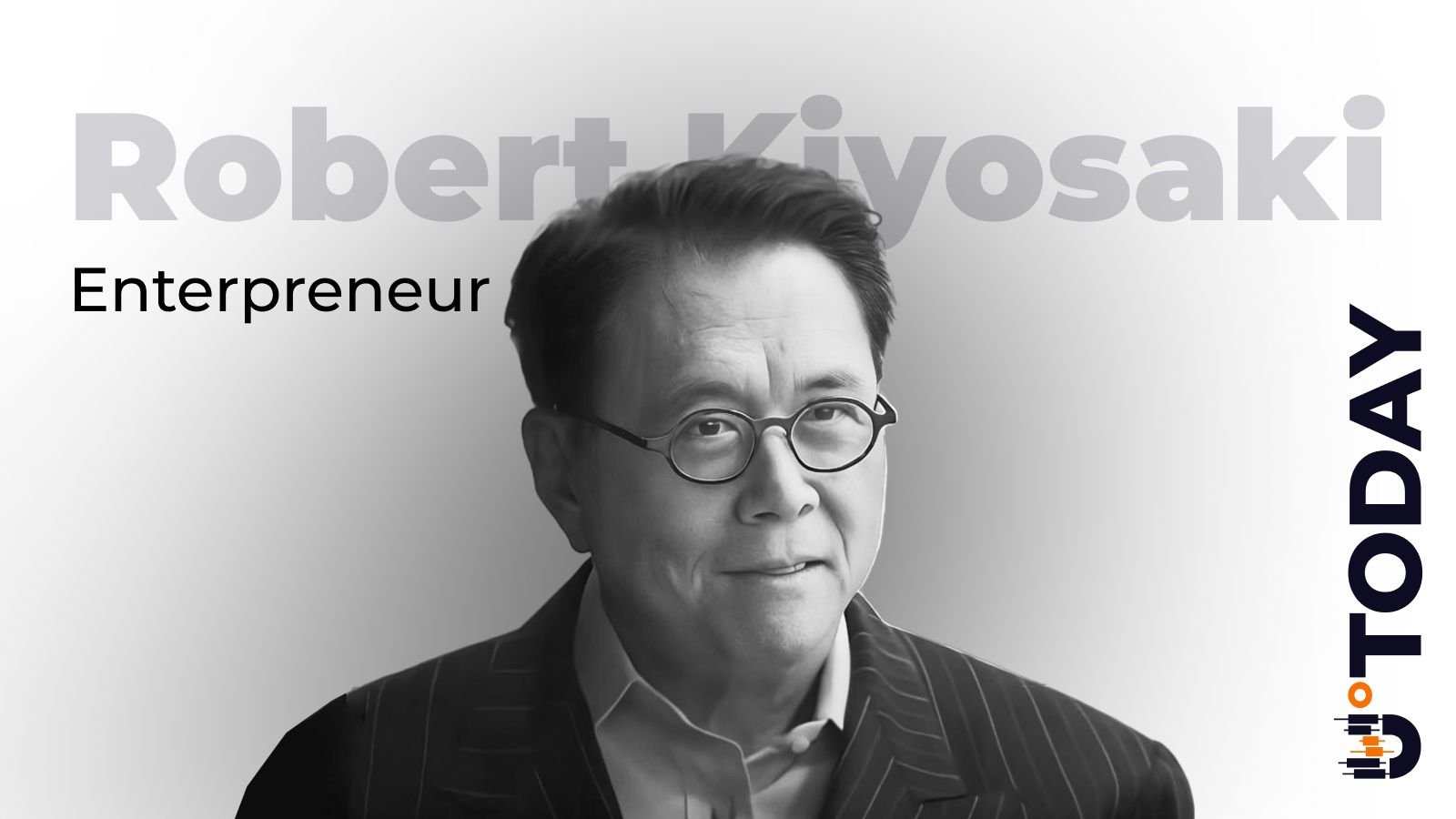

In a recent statement, Robert Kiyosaki, the author of “Rich Dad Poor Dad,” shared insights on when he plans to increase his Bitcoin (BTC) holdings. With over 2.8 million followers on X, Kiyosaki cautioned investors against the common mistake of waiting for the market crash to end before buying Bitcoin.

Kiyosaki pointed out that the total supply of Bitcoin is capped at 21 million, rendering it a scarce asset. He argued that those who wait for market stabilization might end up purchasing Bitcoin at higher prices than during the current dip. His stance reflects a broader understanding of market dynamics and the implications of supply limitations.

In a previous post, Kiyosaki utilized a “question and answer” format to elaborate on his decision to hold onto his assets. Despite the ongoing decline in cryptocurrency values, he remains committed to his investment strategy, which includes Bitcoin, gold, silver, and Ethereum (ETH). He views the present price volatility as a typical market fluctuation rather than a cause for alarm.

According to Kiyosaki, the recent crash can be attributed to a worldwide surge in demand for cash. He believes that individuals with sufficient cash flow, like himself, have no need to liquidate their assets during downturns. He emphasized that those who are forced to sell assets typically do so out of financial necessity.

Furthermore, Kiyosaki noted that the prevailing market conditions are not indicative of Bitcoin”s inherent value. Instead, he believes that sellers are responding to personal financial pressures rather than fundamental flaws in the cryptocurrency itself. He expressed concern over global debt levels and predicted that governments would resort to printing more money, which could lead to inflation and currency devaluation.

Such economic conditions could ultimately benefit hard assets like Bitcoin, gold, and silver, as they tend to appreciate when fiat currencies falter. Kiyosaki remains optimistic about Bitcoin”s future, asserting that once the excessive money printing fails, Bitcoin will likely rebound to higher valuations.

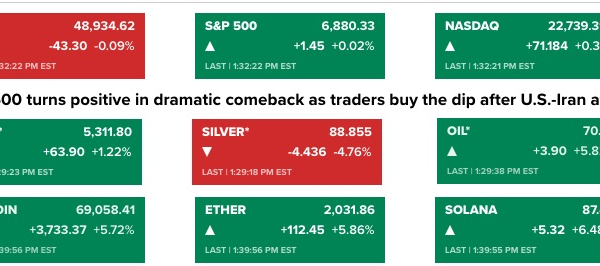

As for the current market trends, Bitcoin has recently experienced a decline, dropping from $97,301.96 to a low of $94,000.73, marking a decrease of over 1.08%. At the time of writing, Bitcoin is trading at $95,804.80, reflecting a 1.2% decline. Trading volume has also seen a significant drop of 16.69%, standing at $95.33 billion, indicating a cautious approach from investors as they monitor market developments.

Despite the lower trading volume, Kiyosaki believes that accumulating Bitcoin during this downturn presents a valuable opportunity for individuals seeking to protect themselves against inflation and currency devaluation.