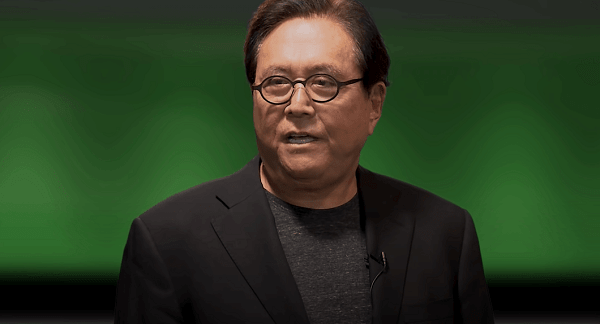

On February 8, 2026, Robert Kiyosaki reiterated his commitment to acquiring Bitcoin despite ongoing price fluctuations. This statement comes amid skepticism regarding his previous comments on Bitcoin investments, particularly as the cryptocurrency hovers around the $90,000 to $100,000 mark.

The controversy resurfaced after critics highlighted what they perceived as contradictions in Kiyosaki”s statements. Previously, he claimed to have purchased Bitcoin at around $6,000, while now he encourages buying at significantly higher prices. Detractors argue that this reflects inconsistent market timing advice, thus calling into question his credibility.

Kiyosaki responded firmly, asserting that his investment strategy values the amount of assets owned over the specific timing of purchases. He emphasized that he does not obsess over the exact dates of his investments, stating, “To the person who said I was lying that I bought Bitcoin at $6000… I know my strike price not the date he falsely accuses me of the date I bought Bitcoin on.”

This exchange highlights a fundamental disagreement between those focused on price-point timing versus asset accumulation. Kiyosaki maintains that even if Bitcoin were to revert to $6,000, he would view this not as a setback but as a prime opportunity to enhance his holdings.

Kiyosaki”s philosophy is rooted in his long-standing “Rich Dad” investment framework, which prioritizes asset allocation over precise entry timing. He argues that the current financial landscape, characterized by extensive debt and monetary policy issues, makes it crucial to convert what he terms “fake money” into tangible assets that are less susceptible to devaluation.

Although Kiyosaki primarily identifies Bitcoin as his digital hedge, he is now expanding his focus to include other assets, particularly Ethereum. This shift suggests a more diversified investment approach that blends scarcity with utility and long-term adoption.

As of now, Kiyosaki”s asset composition remains consistent, featuring Bitcoin as a digital store of value, alongside gold and silver as traditional monetary hedges, and expanding into Ethereum for its utility potential. He also emphasizes the importance of real assets like real estate and agriculture for generating cash flow.

Kiyosaki”s recent comments come as Bitcoin tests the $60,000 mark after a notable correction. His insistence on maintaining a buy-and-hold strategy amid market volatility aligns with the belief among supporters that recent sell-offs represent temporary shakeouts rather than fundamental weaknesses. However, analysts caution that such drawdowns can be challenging for retail investors, who may not have the financial resilience to weather significant downturns.

Ultimately, Kiyosaki”s message is clear: market volatility serves to reinforce his investment strategy rather than derail it.