In a strategic move reflecting growing market confidence, Michael Saylor”s firm, known for being the largest public holder of Bitcoin, has expanded its BTC holdings by acquiring an additional 487 bitcoins for approximately $50 million. This acquisition, detailed in a regulatory filing with the U.S. Securities and Exchange Commission (SEC), took place between November 3 and November 9.

The firm invested about $49.9 million in this latest round, paying an average price of $102,557 per Bitcoin. Following this purchase, the company”s total Bitcoin stash has reached an impressive 641,692 BTC, which is currently valued at around $67.4 billion based on Bitcoin trading at approximately $105,085, according to CoinGecko.

This latest acquisition is part of a series of smaller purchases that Saylor”s company has been making recently. The funding for this significant buy was sourced from the proceeds of the firm”s Stretch (STRC) series of preferred stock, which raised $26.2 million, while additional funds were obtained through an Automated Teller Machine (ATM) related to the Strategy”s STRF “Strife” preferred shares. The average cost of the company”s Bitcoin acquisitions has now risen slightly to $74,079.

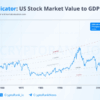

Michael Saylor, co-founder and Executive Chairman of the firm, expressed his ongoing commitment to Bitcoin”s potential, remarking on social media with “₿est Continue,” alongside a graph illustrating the company”s previous Bitcoin purchases. Notably, the company has pioneered a strategy that has inspired over 200 other publicly traded entities to adopt similar practices.

Saylor”s bullish outlook on Bitcoin remains evident, as he recently stated in an interview with CNBC that he anticipates the cryptocurrency”s price could “grind up” to $150,000 by the end of this year, indicating a strong belief in Bitcoin”s long-term value proposition.

This acquisition further solidifies the firm”s position as the leading cryptocurrency treasury company in the marketplace, underscoring its significant influence in the evolving landscape of digital assets.