Investor Michael Burry has expressed grave concerns over the future of Bitcoin, suggesting that a drop below $60,000 could initiate a disastrous chain reaction across financial markets. His predictions extend beyond cryptocurrency, potentially impacting precious metals like Gold and Silver.

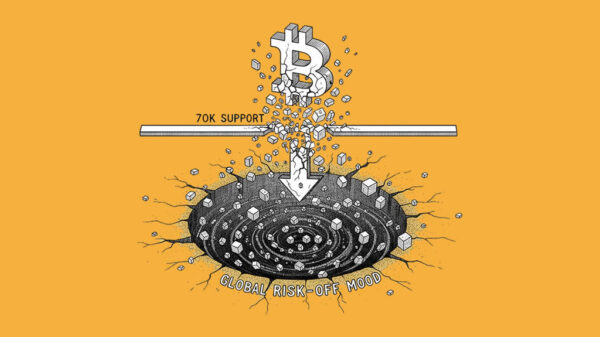

After Bitcoin fell below $75,000 recently and tested the critical psychological level of $70,000, Burry”s warnings became even more urgent. The cryptocurrency has struggled significantly, particularly in 2025, underperforming against traditional assets.

In a recent post on Substack, Burry highlighted the pressing issues facing Bitcoin, noting that large investors might have been forced to liquidate positions in Gold and Silver to cover their losses in cryptocurrency. “It looks like up to $1 billion in precious metals were liquidated at the month”s very end as a result of falling crypto prices,” he stated. His analysis suggests that asset managers are under increasing pressure to maintain positive fund performance.

Burry”s outlook on Bitcoin is particularly bleak. He remarked, “There is no organic use case reason for Bitcoin to slow or stop its descent.” He warned that should the price plunge to $50,000, mining firms could face bankruptcy, and the market for tokenized metals futures might collapse without buyers.

Moreover, Burry has dismissed the notion of Bitcoin being a viable option for company or state treasuries, labeling it a passing trend rather than a secure investment. He views the digital asset as a speculative gamble devoid of safety in turbulent times.

While Burry”s skepticism is well-documented, it is essential to recognize that Bitcoin has evolved into a trillion-dollar asset over the past decade, despite his long-standing criticisms. As the cryptocurrency market continues to experience volatility, the implications of Burry”s predictions could reverberate far beyond the digital realm, potentially affecting broader financial landscapes.

The market is currently in a precarious state, with no clear support levels in sight. Investors and stakeholders will be watching closely as the situation unfolds, particularly in light of Burry”s historical track record of predicting market downturns.