The renowned investor Michael Burry, known for his role in “The Big Short,” recently shared insights about Bitcoin (BTC) on X, previously Twitter, on February 4. His post, which included a multi-year chart, pinpointed significant price levels that could indicate troubling trends for the cryptocurrency.

Burry”s chart featured two distinct markers, both highlighted with red arrows. The first arrow traced the downward trajectory from a local peak on April 2, 2022, down to a period of stabilization observed in mid-May and early June. The second arrow illustrates the current decline in early February 2026, suggesting a possible echo of Bitcoin”s past price movements.

In a manner reminiscent of historical oracles, Burry—who refers to himself as “Cassandra Unchained”—has not provided exhaustive details in his post. However, the implications are clear: he believes the cryptocurrency landscape, particularly Bitcoin, may be experiencing conditions akin to those of the second quarter of 2022.

To provide context, Bitcoin started its descent from well above $60,000 in November 2021, plummeting to around $35,000 by January 2022. After a brief recovery to approximately $45,000 in early April, the price fell sharply, reaching around $30,000 by mid-May before crashing below $19,000 in June 2022. If Burry”s analysis holds true, a similar pattern could unfold, potentially resulting in a further decline of up to 40% by late March.

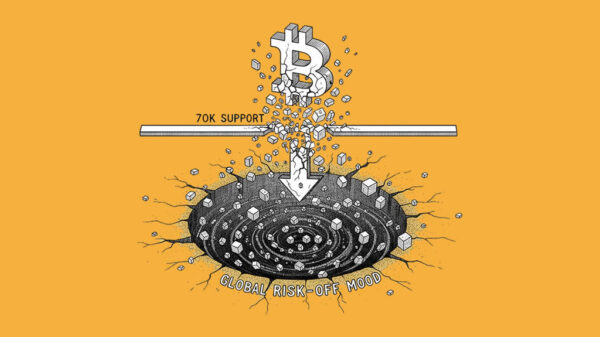

Currently trading at $69,553, a significant drop could see Bitcoin”s price fall to around $41,000 in just over a month. If Burry”s projections materialize, Bitcoin may stabilize and engage in sideways trading before attempting another upward trajectory in 2027.

Burry has also cautioned about the implications of Bitcoin”s declining price, suggesting it could instigate a “death spiral” for risk assets. Companies heavily invested in Bitcoin, such as Michael Saylor”s Strategy, could face substantial risks as the market fluctuates.

This sentiment is echoed by other influential figures in finance. Jim Cramer has recently emphasized the importance of maintaining a critical price level, previously around $73,000, to ensure market stability. Concurrently, blockchain analyst Ali Martinez has indicated that Bitcoin”s relationship with the 100-week and 200-week simple moving averages (SMA) suggests a potential drop below $57,000 in the coming months.

As the situation continues to evolve, market participants are advised to remain vigilant and closely monitor these developments, especially in the context of broader economic factors impacting the cryptocurrency sector.