Robert Kiyosaki, the influential author renowned for his financial insights, has made headlines once more by revealing his recent acquisition of Bitcoin. Amidst a backdrop of market volatility, Kiyosaki bought a full Bitcoin at approximately $67,000, reinforcing his belief in the resilience of digital assets during uncertain economic conditions.

Kiyosaki has expressed significant concerns regarding the US dollar, particularly emphasizing the impact of America”s escalating national debt. He suggests that the government may resort to an extensive money-printing initiative, which he refers to as “The Big Print.” This, he forecasts, could lead to the injection of trillions of dollars into the economy, ultimately exacerbating inflation and diminishing the dollar”s value.

As traditional currencies continue to lose ground, Kiyosaki views cryptocurrencies, especially scarce assets like Bitcoin, as viable long-term financial refuges. He has consistently identified gold, silver, and Bitcoin as dependable stores of value that can counteract the aggressive monetary policies enacted by governments globally.

Bitcoin”s Unique Scarcity

One of the key reasons driving Kiyosaki”s decision to increase his Bitcoin holdings is the cryptocurrency”s intrinsic scarcity. The Bitcoin protocol imposes a permanent cap of 21 million coins, ensuring that no additional supply can be generated. Kiyosaki believes that this distinctive feature enhances Bitcoin”s potential as a reliable store of value over time. As Bitcoin”s supply remains strictly limited due to its decentralized blockchain architecture, Kiyosaki argues that its scarcity will only become more pronounced, making it increasingly attractive to long-term investors.

Kiyosaki”s Investment Strategy

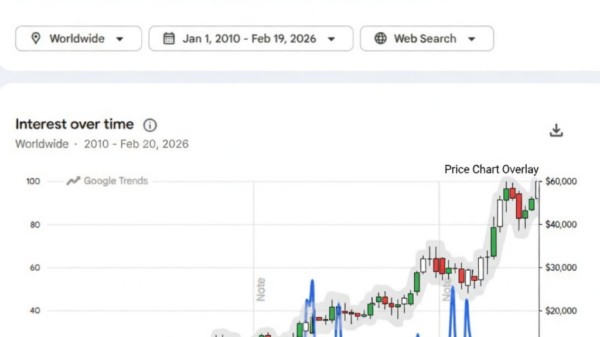

Staying true to his investment philosophy, Kiyosaki strategically timed his latest Bitcoin purchase to align with a market dip. He advocates for acquiring valuable assets during periods of price corrections, highlighting the potential of such moments to present excellent opportunities for discerning investors. Kiyosaki emphasizes the importance of patience and cautions against panic selling during downturns, instead encouraging gradual accumulation of long-term positions in Bitcoin. He asserts that Bitcoin could serve as a protective measure, particularly if traditional fiat currencies face further devaluation in the foreseeable future.

With the ongoing challenges facing traditional currencies, Kiyosaki”s bold move into Bitcoin underscores a growing sentiment among investors regarding the importance of diversifying into digital assets.