Renowned financial author Robert Kiyosaki has once again drawn attention to Bitcoin as he navigates through the current economic landscape. Recently, he made headlines by purchasing an additional Bitcoin at a price of $67,000, reflecting his unwavering confidence in the cryptocurrency market, particularly during periods of volatility.

Kiyosaki has expressed serious concerns regarding the escalating national debt in the United States. He speculates that this situation could lead to extensive monetary expansion, potentially forcing the Federal Reserve to engage in substantial currency creation. Such actions, he warns, could destabilize the value of the US dollar and fuel inflation.

In light of these economic pressures, Kiyosaki advocates for the use of cryptocurrencies, viewing them as a safeguard in times of traditional currency depreciation. He positions Bitcoin, along with gold and silver, as reliable stores of value, suggesting that these assets could serve as a counterweight to the aggressive monetary strategies employed by global economic authorities.

The Value of Bitcoin”s Scarcity

Central to Kiyosaki”s endorsement of Bitcoin is its capped supply, which is limited to a maximum of 21 million coins. He argues that this scarcity enhances Bitcoin”s role as a stable store of value, potentially outshining precious metals. The finite nature of Bitcoin, defined by its underlying blockchain technology, underscores its uniqueness and appeal to investors seeking alternatives to government-issued currencies.

Kiyosaki”s Investment Strategy

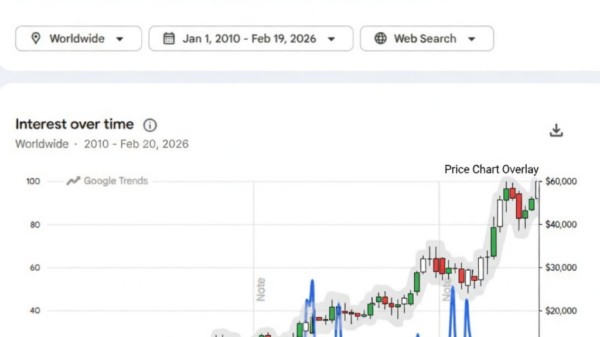

Kiyosaki”s recent acquisition aligns with his strategy of buying during market downturns. This method emphasizes his belief that price declines present opportunities for long-term investors. He advises caution during turbulent market periods, discouraging impulsive sales and promoting strategic accumulation of robust assets to hedge against the potential devaluation of fiat currencies.

Key takeaways from Kiyosaki”s perspective include the following:

- Increasing US debt may prompt excessive currency printing, negatively impacting the dollar”s value.

- Investing in Bitcoin and other scarce assets could provide protection as traditional currencies weaken.

- Bitcoin”s limited supply enhances its attractiveness for future investments.

- Strategically buying during market dips is essential for prudent long-term asset accumulation.

As economic pressures mount, Kiyosaki”s insights continue to resonate within investment circles that are increasingly gravitating toward alternative asset classes. His advocacy for digital currencies as stable financial refuges underscores a growing trend among investors seeking to navigate uncertain economic climates.