Bitcoin faces increased uncertainty as the U.S. government shutdown concludes, leaving traders without crucial economic indicators. The White House has indicated that October”s inflation and employment data will likely remain unreleased, complicating the Federal Reserve”s policy decisions.

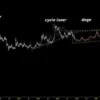

This lack of data has raised concerns among market participants, with Bitcoin declining by 1.1% over the last 24 hours and currently trading at $102,100, reflecting a broader 10% drop this past week. The atmosphere of uncertainty has led prediction markets to adjust their expectations, particularly regarding the future price movements of Bitcoin.

As the White House press secretary Karoline Leavitt stated, “The Democrats may have permanently damaged the Federal Statistical system with October CPI and jobs reports likely never being released.” This situation has put policymakers at the Federal Reserve in a difficult position, as they are now “flying blind” during a critical period for economic decision-making.

The shutdown, now the longest in U.S. history, stemmed from political disagreements over tax credit extensions aimed at reducing healthcare costs for millions of Americans. Although a bill to reopen the Federal government has passed and been signed by President Donald Trump, the ramifications of the data blackout are already altering the financial landscape.

Adam Chu, chief researcher at GreeksLive, emphasized the implications of the lost data, noting that it amplifies the uncertainty surrounding upcoming economic releases, providing agencies with “greater maneuvering room.” This has resulted in a notable shift in market sentiment, with decreasing bullish expectations for Bitcoin among traders.

Currently, the probability of Bitcoin reaching $115,000 before dipping to $85,000 has diminished from 61.4% to 58.8% within a single day, indicating a shift towards more cautious outlooks. Furthermore, traders have adjusted their expectations for a potential interest rate cut in December, now pricing in only a 50% chance of a 25-basis-point reduction.

In a macroeconomic environment where data is sparse, analysts like Tim Sun from HashKey anticipate increased volatility in assets like Bitcoin. Sun indicates that trading might become more sentiment-driven, complicating efforts to maintain upward momentum. This also places Federal Reserve Chair Jerome Powell in a challenging position, as a data-dependent approach is integral to their policy framework.

The ongoing uncertainty raises the stakes for the Federal Reserve, which may adopt a more cautious risk-management stance to avoid potential policy missteps in light of the current data vacuum.