In a recent update on the X social media platform, CNBC”s Jim Cramer expressed alarm over the significant drop in Bitcoin“s price, describing the situation as “code red.” He emphasized that the key support threshold for the leading cryptocurrency is set at $73,600.

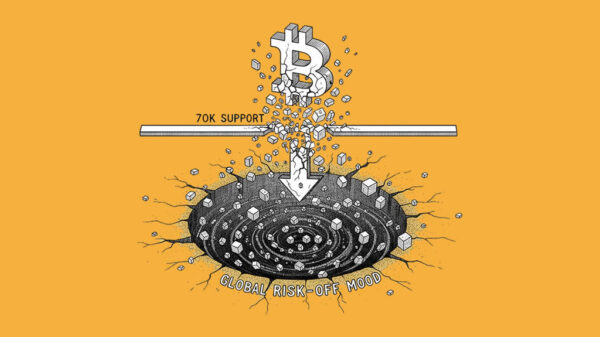

Today, Bitcoin fell to a new yearly low of $72,185, according to data from CoinGecko. This decline is part of a broader market trend characterized by a severe leverage flush, leading to widespread liquidations across the cryptocurrency sector.

Over the last 24 hours alone, liquidations have reached a staggering total of $861.28 million, with approximately $677.53 million originating from long positions. This aggressive sell-off raises questions about the sustainability of the recent market dynamics.

As Bitcoin struggles, it risks marking its fifth consecutive month of losses. Analysts are particularly concerned about the possibility of revisiting the $70,000 level, a threshold that Michael Burry of “The Big Short” fame previously indicated could trigger institutional margin calls. Moreover, there are fears that a further decline could lead to a drop towards Peter Brandt“s target of $54,000.

Despite the current turmoil, Matt Hougan from Bitwise Invest recently suggested that the ongoing crypto winter may be nearing its end. The contrasting views within the market highlight the uncertainty surrounding the future trajectory of Bitcoin and the broader cryptocurrency landscape.