Recent analysis indicates that Google searches for the phrase “Bitcoin is Dead” have surged to an all-time high, peaking at 100 on a relative scale. This surge reflects heightened bearish sentiment in the market, coinciding with Bitcoin trading around $68,000 following a significant 47% price correction since October 2025.

Prominent crypto analyst Rekt Fencer took to X to assert that a “generational rally” might be emerging, suggesting a swift recovery for the leading digital currency from these psychological lows. However, not everyone concurs with this optimistic outlook. Changpeng Zhao (CZ), the founder of Binance, shared Rekt Fencer”s post while expressing his own uncertainty regarding the implications of the uptick in search activity.

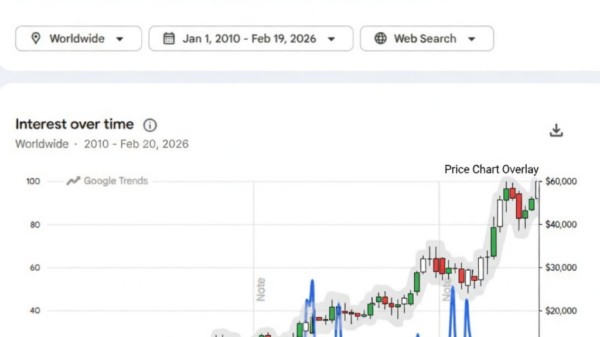

Despite the growing buying sentiment noted in replies to CZ”s tweet, many observers remain skeptical about an imminent price reversal. One user even requested analytics from Grok AI to compare the historical trends of searches for “Bitcoin is dead” and “Bitcoin going to zero” with the cryptocurrency”s spot price chart. The findings revealed a correlation where increased panic-driven searches often align with relative price bottoms.

This phenomenon mirrors similar trends observed in previous market downturns, notably in 2022 when searches spiked as Bitcoin plummeted from $50,000 to $16,000, and in 2018 during its drop from $20,000 to $3,000. Historically, while these search spikes have indicated potential long-term bullish reversals for Bitcoin, they have not typically resulted in immediate price recoveries.

Each of the past instances where Bitcoin was declared “dead”—over 325 times according to data from Bitcoin is Dead—has ultimately led to surprising new highs. Currently, Bitcoin is navigating through a bearish phase, firmly under the $70,000 mark, with recent lows dipping to $60,000. Analysts continue to predict that the market may not have hit its bottom yet, with potential declines to $50,000 or below as multiple short orders accumulate.

As the market evolves, the relationship between public sentiment and price movements remains a critical aspect for investors to monitor. The interplay of fear and optimism in the crypto space is always in flux, and understanding these dynamics can provide essential insights into future trends.