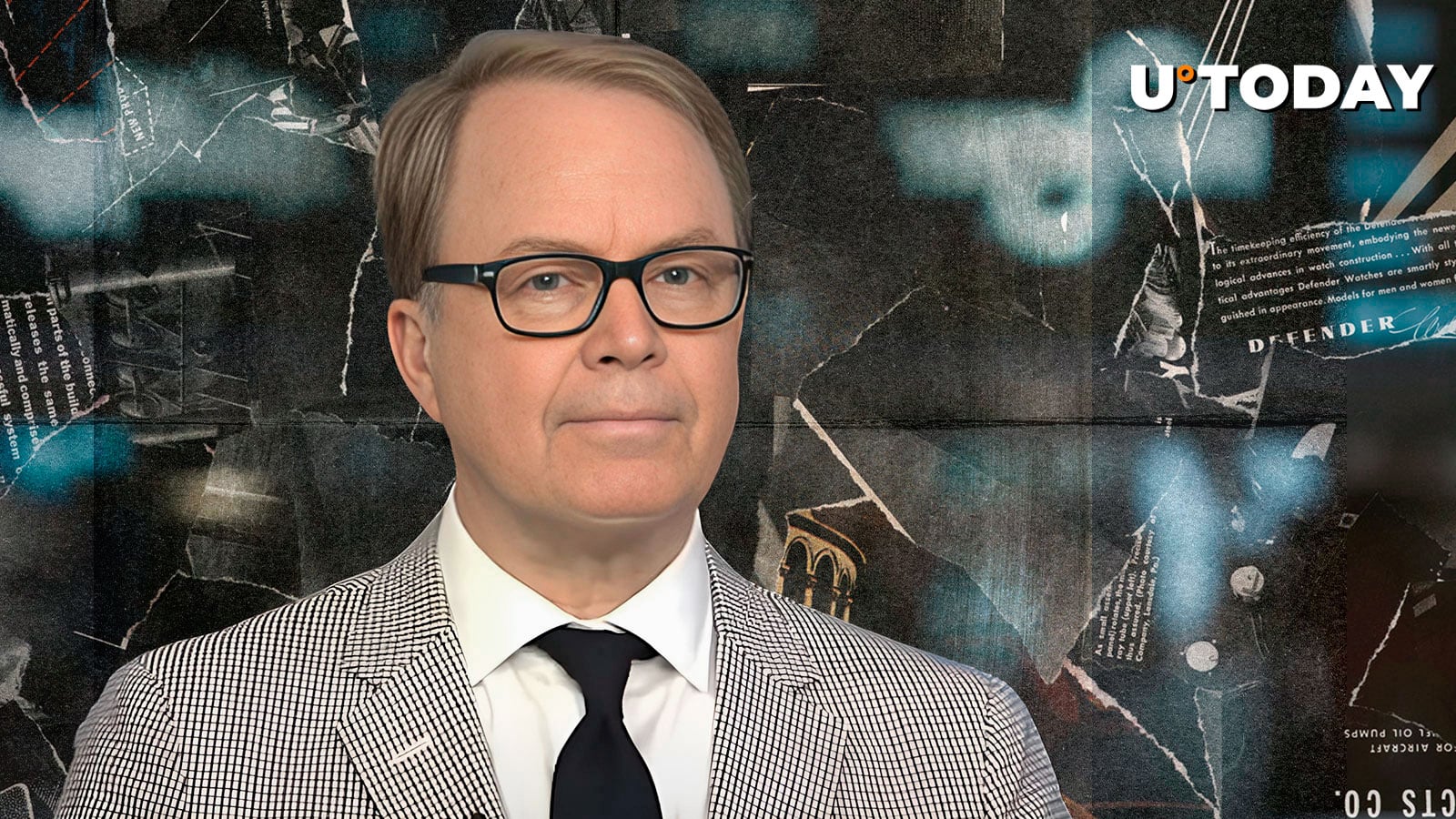

Fidelity Investments has pinpointed $65,000 as a significant buying opportunity for Bitcoin (BTC), suggesting that the cryptocurrency may have found its price floor following a recent V-shaped recovery from a drop to $60,000. Jurrien Timmer, the director of global macro at Fidelity, expressed his views on the current market dynamics impacting Bitcoin.

During a week dominated by macroeconomic headlines, Timmer focused on the technical indicators surrounding Bitcoin. Despite prevailing market fears, he reiterated his belief that $65,000 represents a crucial entry point for investors. “The markets spoke loudly last week to the next Fed Chair being announced,” Timmer remarked, emphasizing his confidence in Bitcoin”s resilience.

In his analysis, Timmer also addressed the recent outperformance of gold, which has reached new all-time highs driven by central bank purchases and geopolitical tensions. He attributes Bitcoin”s relative underperformance to technical positioning rather than any fundamental shortcomings of the asset. “Given the distance between gold and Bitcoin vis-à-vis their support levels,” he stated, “I suspect that gold will continue to outpace Bitcoin until the flows converge further.”

Timmer shared a detailed chart that tracks various commodities and bonds since the cyclical bull market commenced in October 2022. The data underscores a critical observation for traditional investment strategies: long-term bonds are failing to provide adequate protection for investors, while “hard assets” continue to surge in value. “In my view, commodities (including precious metals) remain vital diversifiers in this era of fiscal dominance, regardless of who finances the debt,” he noted.

He highlighted that precious metals have quickly climbed in importance, despite their low correlation with the S&P 500, effectively gaining market share at Bitcoin”s expense in recent months. Conversely, Timmer warned that if long-term bonds regain a positive correlation with stocks, investors will increasingly need uncorrelated assets, including alternative cryptocurrencies, to navigate potential risks.

In a comparative analysis of market capitalizations adjusted for inflation among monetary assets, Timmer pointed out that gold is currently valued at approximately $35 trillion, while both silver and Bitcoin are tied at around $1.8 trillion. Notably, he remarked on the swift pace at which Bitcoin achieved this market cap, contrasting it with silver”s five-thousand-year journey to the same threshold. “It”s remarkable that it took Bitcoin 18 years to reach a market cap of $1.8 trillion; it took silver five millennia,” he concluded, emphasizing the unique trajectory of Bitcoin in the financial landscape.