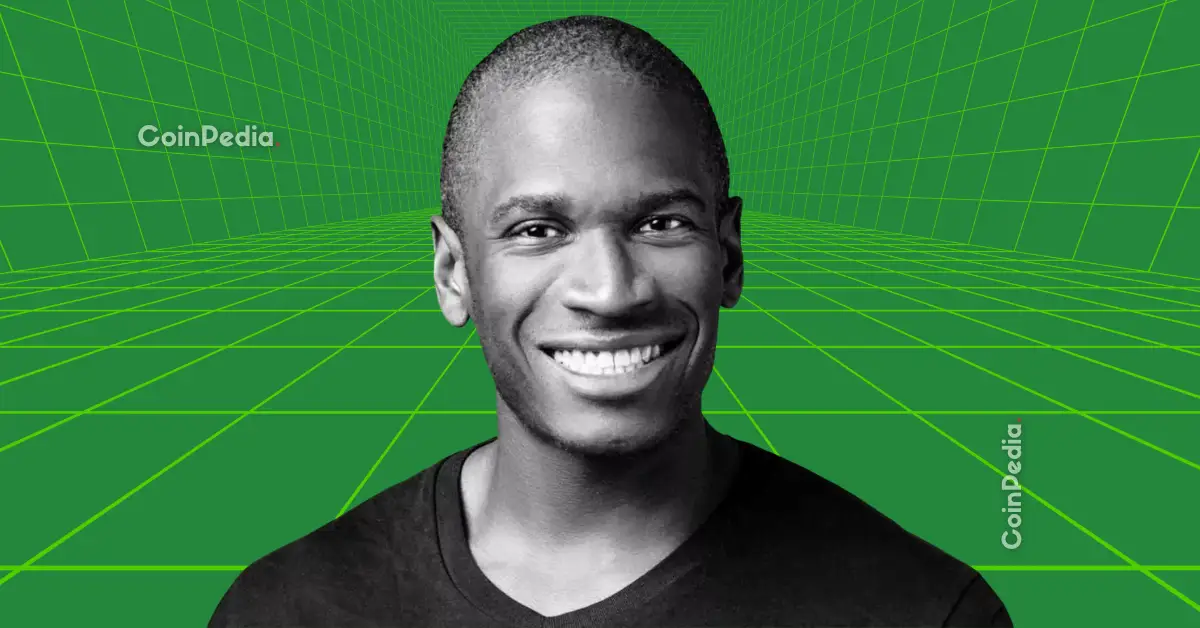

In recent remarks, noted crypto analyst Arthur Hayes has indicated that the Federal Reserve might engage in printing additional dollars to bolster its reserves and acquire Japanese yen. This move would effectively expand its holdings of foreign currency assets, which currently total $19.185 billion.

The Japanese yen witnessed a notable increase, rising as much as 1.75% to reach 155.63 per dollar, amidst speculation surrounding a potential intervention by Japanese authorities. However, no official confirmation has emerged regarding such measures.

Enthusiasts within the cryptocurrency community perceive this potential influx of liquidity as a favorable sign for Bitcoin, which managed to maintain a steady price around $89,500 as of Saturday. Conversely, there are skeptics who question the intentions of the Federal Reserve in this context.

This situation highlights the interconnectedness of traditional financial systems and the cryptocurrency market, with actions taken by central banks having the potential to influence digital asset valuations significantly. Observers will be keen to monitor how these developments play out and their subsequent impact on Bitcoin and the broader crypto landscape.