Changpeng Zhao (CZ), the founder and former CEO of Binance, has acknowledged his contribution to the United Arab Emirates” (UAE) acceptance of Bitcoin as a store of value akin to gold. In a recent tweet, he noted, “I might have done a tiny bit of advocacy for this,” highlighting his efforts in promoting cryptocurrency within the region.

The UAE has significantly increased its Bitcoin holdings over the years, amassing a portfolio that now exceeds $1 billion. This growth has been facilitated by various initiatives, including extensive Bitcoin mining operations and investments in exchange-traded funds (ETFs).

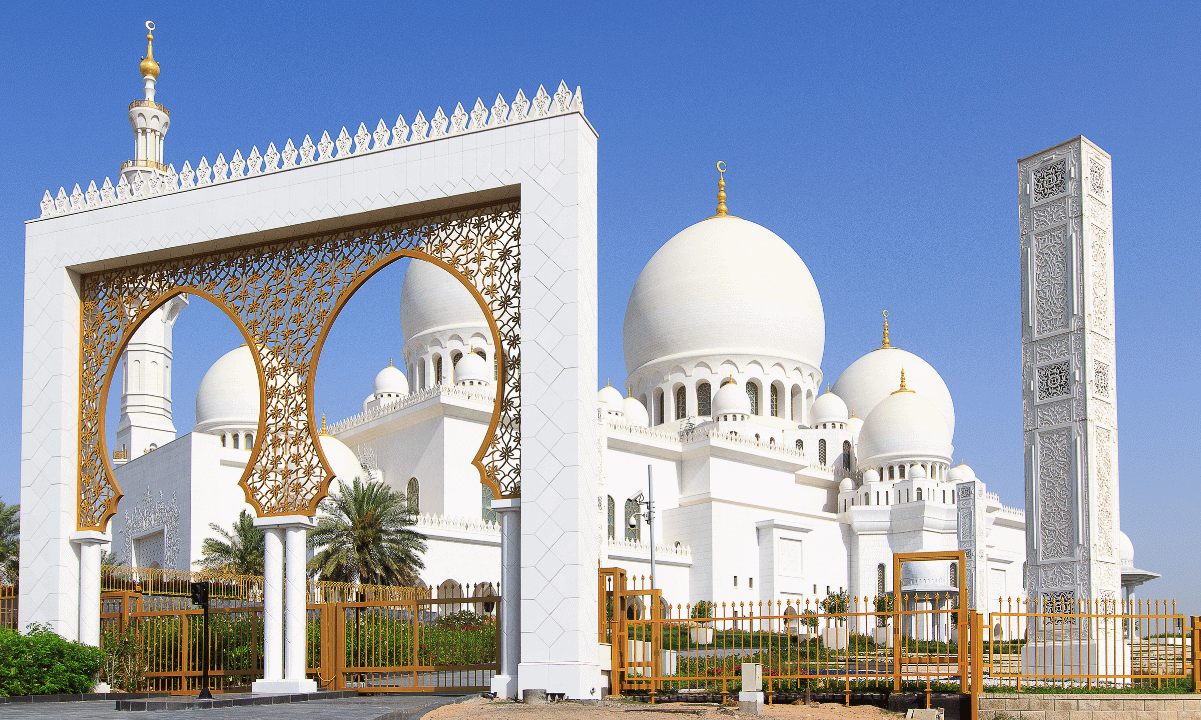

Since relocating to Dubai in 2021 due to its favorable regulatory environment for cryptocurrencies, CZ”s presence has evidently influenced local leaders and entrepreneurs. Notably, the royal family of Abu Dhabi has taken considerable steps in the Bitcoin mining sector through its investment firm, Citadel Mining. This initiative has established large-scale mining operations on AI Reem Island, with the family reportedly accumulating over $450 million in Bitcoin.

Recent data from the market intelligence platform Arkham revealed that the UAE has successfully mined approximately 453.6 BTC, with the majority of this Bitcoin still held in reserve. The last recorded outflow occurred four months ago, indicating a strategic holding approach that has yielded a profit of $344 million, after accounting for energy costs.

In addition to mining, two prominent Abu Dhabi sovereign wealth funds, Mubadala Investment Company and Al Warda Investments, have invested heavily in Bitcoin ETFs. As of the end of last year, Mubadala reportedly held over 12.7 million shares in BlackRock”s iShares Bitcoin Trust (IBIT), while Al Warda owned at least 8.21 million shares. The combined value of these investments was approximately $1 billion, despite the fluctuations in Bitcoin prices.

With the UAE”s government officially recognizing Bitcoin as a store of value, the cryptocurrency is likely to be regarded as a permanent reserve asset moving forward. This strategic shift underscores the growing acceptance of Bitcoin and its potential role in global finance.