The Bitcoin options market is witnessing a notable shift as traders increasingly turn to put options, indicating expectations of further price declines. Recent trends highlight a growing demand for risk mitigation strategies, with market participants opting for protective positions ahead of upcoming expiration periods.

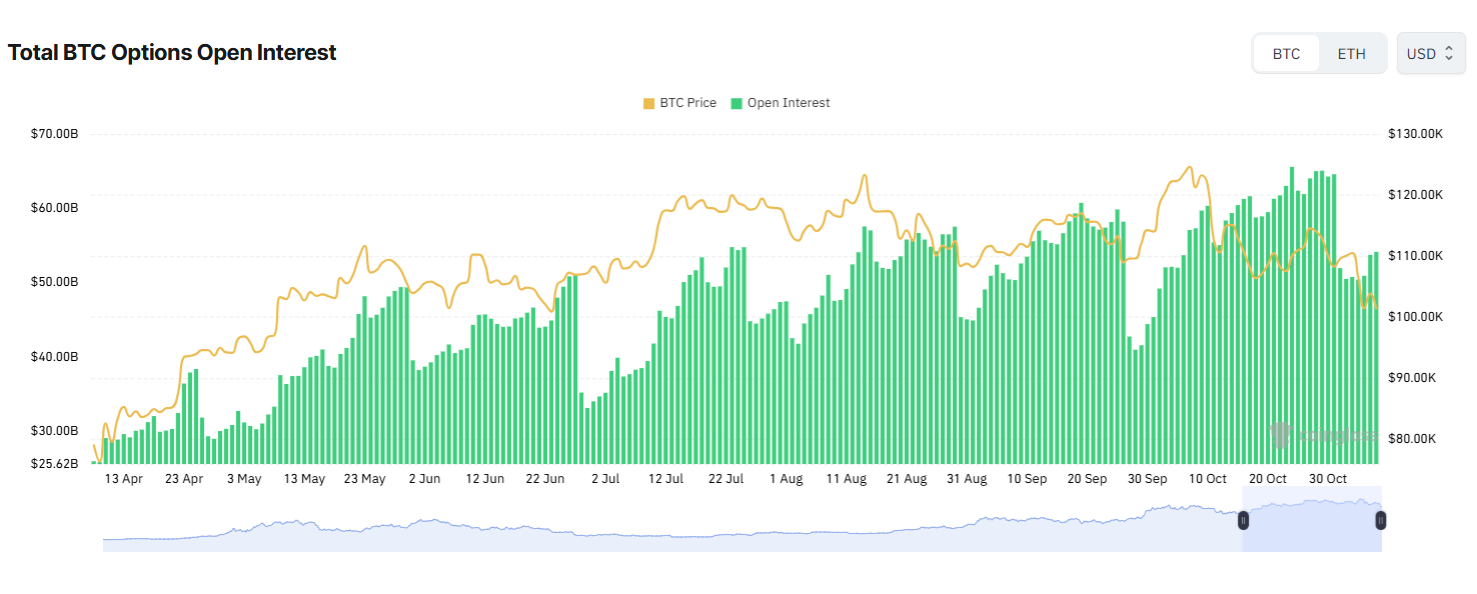

In October, the open interest for BTC options peaked and has seen a resurgence in November following a substantial monthly expiry that totaled $17 billion in notional value. This renewed interest reflects a cautious sentiment among traders, who are now paying premiums for put options situated around the $100,000 mark. The market currently displays minimal enthusiasm for buying the dip, suggesting a definitive shift toward protective trading strategies.

Deribit continues to dominate the options market, serving as the primary platform for hedging activities. The overall BTC open interest remains under $33 billion, with a recent pattern of daily long liquidations contributing to the erasure of newly accumulated liquidity. Historical data from Glassnode indicates that after each monthly expiry in 2025, BTC options interest has rebounded to a higher baseline, reinforcing the market”s growth.

October marked a significant milestone, with total options volumes reaching an impressive $202 billion, the highest recorded in the past year. This upward trend in trading volumes has persisted into early November as traders seek protection against potential price dips.

Further analysis from Glassnode reveals that since the price range of $107,000, BTC options activity has remained elevated, reflecting a combination of position reshuffling and new market entrants hedging their bets. The dominance of put options underscores a prevailing lack of confidence in a swift recovery. Although there has been a recent uptick in call options, the prevailing strategy leans heavily towards put options.

Notably, the largest accumulation of put options is concentrated at the $95,000 level per BTC, indicating that traders are bracing for another potential downturn. This inclination toward placing put options reveals a short-term focus, predominantly skewed to the nearest month. While longer-term options still reflect a significant number of puts, sentiment appears slightly more optimistic for the months ahead.

The cautious sentiment among traders has intensified following October 10, as many express skepticism regarding a rapid recovery. As a result, put options have been driven lower, contrasting with the previous positioning that favored the $100,000 to $107,000 range. During the latest weekly expiry, approximately $5 billion in positions expired, once again highlighting the preference for puts over calls.

According to insights from Deribit, traders are engaging in substantial hedging activities without displaying signs of panic. Call options are gaining traction above the $120,000 mark, extending up to $125,000. However, Bitcoin continues to operate within an atmosphere of extreme fear, with the sentiment index dipping to 24 points. Following the recent weekly options expiry event, BTC is trading around $100,676.