The recent downturn in Bitcoin (BTC) has begun to create significant challenges for publicly traded companies that have structured their financial strategies around the leading cryptocurrency. On Thursday, Bitcoin was trading near the $65,000 mark, continuing a steep decline that commenced last October. This drop has adversely affected equity markets, resulting in substantial losses for firms heavily exposed to crypto assets.

According to a report from Reuters, the ongoing volatility in digital assets is exerting downward pressure on the stock prices of companies that hold Bitcoin and other cryptocurrencies, raising concerns about potential systemic stress within the sector. The past year saw a surge in publicly traded firms investing in cryptocurrencies, as many executives anticipated continued long-term appreciation of digital assets. However, the market landscape has shifted dramatically.

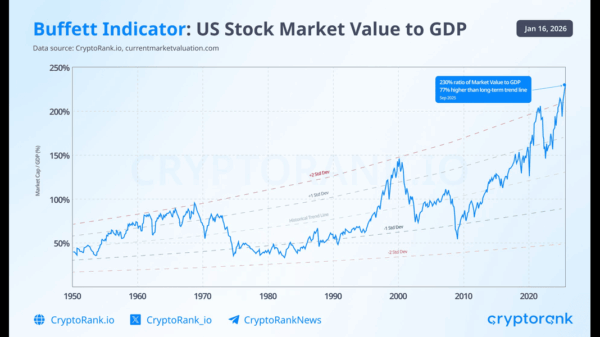

Investor unease over inflated valuations in artificial intelligence (AI) stocks, coupled with uncertainty about the Federal Reserve”s future interest rate policies, has impacted risk assets across the board. Consequently, Bitcoin has fallen to its lowest levels since October 2024, placing additional strain on businesses that rely on digital asset holdings.

Notably, several major companies are experiencing severe repercussions. MicroStrategy, now known as Strategy, holds the distinction of being the largest corporate holder of Bitcoin with over 700,000 coins. This firm has faced a dramatic decline in its share price, plummeting from approximately $457 in July to as low as $106 on Thursday. In December, the company revised its earnings outlook for 2025 downward due to the persistent weakness in Bitcoin prices, and it also announced plans to create a reserve to support dividend payments.

Led by Michael Saylor, MicroStrategy now anticipates its full-year results could vary from a $6.3 billion profit to a $5.5 billion loss, a stark contrast to its prior forecast of a $24 billion net profit.

Other firms with a focus on Bitcoin have also been adversely affected. The UK-based Smarter Web Company saw its shares decrease by nearly 18% on Thursday. Competitors such as Nakamoto Inc and Japan”s Metaplanet also faced declines, dropping nearly 9% and over 7%, respectively. The sell-off pressure is not confined to companies that solely hold Bitcoin. On Thursday, various crypto-related firms that have stockpiled other digital tokens experienced declines as well, amid the overall correction impacting digital asset values.

For instance, Alt5 Sigma, which announced plans last year to acquire the Trump family”s World Liberty Financial (WLFI) token, saw its shares drop by 8.4%. Similarly, SharpLink Gaming, which possesses Ethereum (ETH), experienced a decline of approximately 8%, while Forward Industries, holding Solana (SOL), slipped nearly 6%.

As the market continues to navigate this turbulent environment, the implications for corporate players heavily invested in Bitcoin and other cryptocurrencies remain significant.