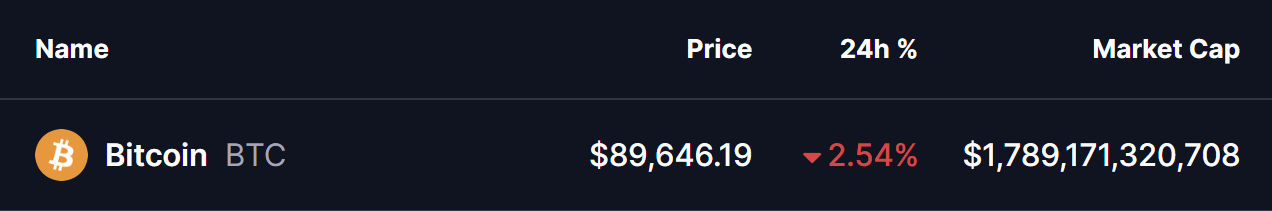

Bitcoin is experiencing a fragile recovery, with recent price movements indicating potential instability. After rebounding from a low of $83,822 on December 1 to a local high of $94,150 on December 4, the price has retraced to approximately $89,646. This pullback has led to decreased spot trading volume and a decline in futures open interest, suggesting that traders are exercising caution amid a stall in momentum.

On-chain analysis reveals that this weakness does not stem from panic selling; rather, it appears to be a case of strategic profit-taking by miners and large holders, often referred to as whales. These entities capitalized on the brief rally as an opportunity to secure their gains.

According to crypto analyst ALI, miners, particularly those who have held their coins for an extended period, have begun to realize profits as BTC approached $94,000. Data from CryptoQuant indicates that miner realized profits surged to $4.344 million on December 2, a considerable increase from under $1 million just a week prior. As the price slipped again, realized profits decreased to around $3 million, suggesting miners might hold off on further selling unless there is a more significant drop in Bitcoin”s price.

Whale activity has also been notable during this period. ALI”s metrics show that long-term holder whales generated approximately $86.096 million in profits by December 3. This shift from negative realized profits in mid-November to significant gains corresponds with typical whale behavior, where they accumulate during downturns and distribute when prices rise.

Despite the selling pressure from miners and whales, inflows into spot exchange-traded funds (ETFs) have remained stable, potentially mitigating deeper corrections. Nevertheless, ongoing selling from whales could make the $95,000 resistance level challenging to breach.

Another critical indicator is the 730-day simple moving average (SMA), currently situated around $82,150. Historically, this level has delineated the boundary between prolonged downtrends and recoveries. Although BTC is currently above this SMA, its proximity raises concerns. A decline below $85,000 could trigger a retest of this level, which has previously led to more severe corrections, as seen in 2022.

If Bitcoin can reclaim the $92,000 mark, it may restore bullish momentum and potentially set the stage for a run towards $100,000 before the year concludes.

In summary, while ALI”s analyses do not indicate an imminent crash, they highlight a delicate market environment where profit-taking is hindering upward movement rather than causing outright reversals. The macroeconomic landscape and Bitcoin”s historical performance in December contribute to this cautious sentiment among traders. Mid-tier holders are continuing to accumulate, and the dynamics of the long-term halving cycle remain favorable for bullish sentiment. Currently, the $82,000 level serves as a crucial support point; maintaining it could allow for a late-December rally, whereas a loss could push Bitcoin toward the high-$70,000 range.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author”s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to conduct independent research and make decisions aligned with their individual risk tolerance.