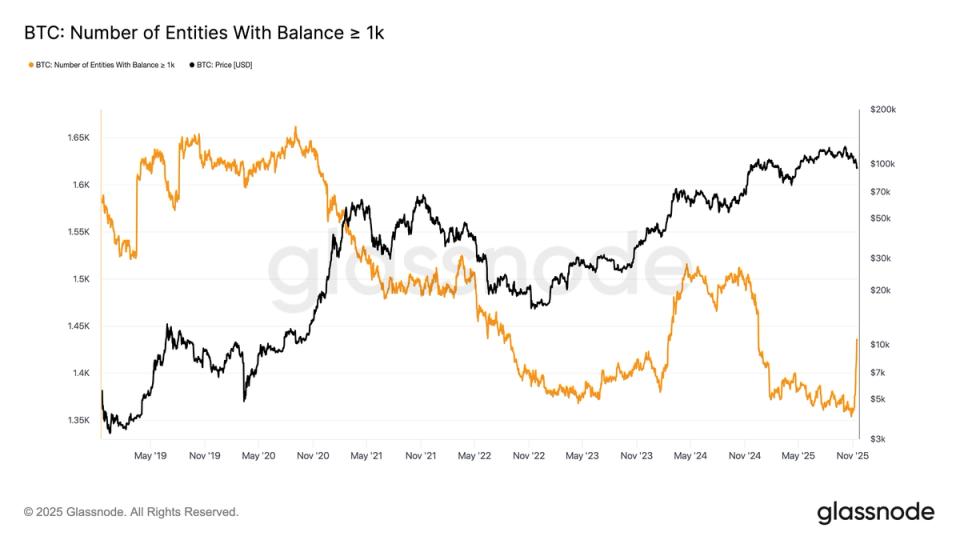

The cryptocurrency landscape is witnessing a noteworthy shift as the number of unique entities holding at least 1,000 BTC has risen to 1,436. This increase comes despite Bitcoin remaining firmly below the $100,000 mark. The trend marks a significant turnaround from the broader pattern observed in 2025, where long-term holders and “OGs” were predominantly net sellers.

To provide some context, this group of large holders peaked at over 1,500 entities in November 2024, coinciding with the bullish sentiment following Donald Trump”s election victory. However, by October, this number had decreased to roughly 1,300 entities. The last time a similar price rally was accompanied by an increase in large holder entities was in January 2024, just before the U.S. ETF launch, when the count rose from 1,380 to 1,512 entities. Ultimately, Bitcoin reached a high of approximately $70,000 a few months later.

Further insights are provided by the Accumulation Trend Score from Glassnode, which analyzes the behavior of wallet cohorts. This metric evaluates the strength of coin acquisition across various balance tiers based on entity size and the volume of coins accumulated over a recent 15-day period. A score approaching one indicates accumulation, while a score nearing zero signifies distribution. Notably, entities such as exchanges and miners are not included in this analysis.

For the first time since August, whales holding over 10,000 BTC have ceased to be heavy sellers, with their score now hovering around 0.5. Meanwhile, those holding between 1,000 and 10,000 BTC are demonstrating modest accumulation. The most significant accumulation activity is occurring among holders with between 100 to 1,000 BTC and wallets containing less than 1 BTC. This data suggests a growing belief among both large and small holders that Bitcoin is currently undervalued.

As the market continues to react to various external and internal factors, the behavior of these large holders will be critical in determining future price movements. The ongoing accumulation by whales and smaller entities alike could signify a potential foundation for a price rebound, although the current market dynamics remain complex.