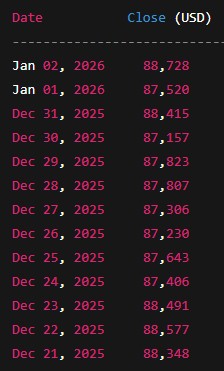

Bitcoin has embarked on 2026 with a sense of uncertainty, as the leading cryptocurrency struggles to surpass crucial psychological barriers amid broader market pressures. On January 3, 2026, Bitcoin (BTC) commenced trading at approximately $88,000, unable to break through the pivotal $90,000 resistance level that many traders had pinpointed as a key target.

The lack of liquidity during the holiday season and a prevailing sense of caution within the market have led to a period of sideways movement, contrasting sharply with the highs of 2025, where Bitcoin peaked above $126,000. As the previous year drew to a close, Bitcoin recorded its first annual loss since 2022, finishing down by about 5–6 percent.

Despite the subdued price movements, institutional interest remains a significant theme in the market. Notably, major asset managers have reported substantial inflows into spot Bitcoin ETFs, such as an impressive $88 million daily inflow into Fidelity”s Bitcoin ETF, suggesting that traditional investors continue to seek regulated exposure to Bitcoin.

Furthermore, corporate accumulation appears to be on the rise again. Strategy, recognized as the largest corporate holder of Bitcoin, resumed its purchases, acquiring over 1,100 BTC and raising its total holdings to beyond 672,000 BTC.

Market participants are also contending with significant technical factors, as a substantial volume of Bitcoin options, valued at over $1.8 billion, is set to expire in the early days of January. This event could spark increased volatility or reinforce existing market positions as traders adjust their strategies for 2026.

The correlation between Bitcoin and broader risk assets, particularly U.S. equities, has been increasingly evident, challenging the notion of Bitcoin as a purely isolated digital asset and solidifying its role as a risk-on instrument.

Globally, regulatory landscapes are evolving, with policymakers in the United States and other significant regions moving towards frameworks designed to clarify the digital assets market, stablecoin oversight, and overall market structure. While many institutional investors welcome this regulatory clarity, it simultaneously raises compliance expectations for market participants.

In the realm of innovation, developments in Bitcoin infrastructure continue unabated, as companies pursue fresh funding to enhance payment solutions powered by the Lightning Network, aimed at boosting transaction speeds and efficiency—an essential step in scaling Bitcoin beyond the simple store-of-value narrative.

However, the landscape has not been without its challenges. The FBI has reported a troubling rise in fraud related to Bitcoin ATMs, with U.S. citizens potentially losing over $330 million in 2025. Authorities have indicated that older demographics are particularly vulnerable, resulting in calls for enhanced consumer protections and increased accountability within the industry.

As Bitcoin enters 2026, market analysts remain divided. Optimists draw attention to the institutional inflows, the expansion of regulatory frameworks, and the continuation of corporate accumulation as potential catalysts for renewed growth. Conversely, skeptics point to the persistent failure to establish a lasting breakout above critical technical levels and ongoing volatility influenced by macroeconomic conditions.

The forthcoming weeks will be crucial for Bitcoin as traders closely monitor macro drivers, regulatory developments, and institutional commitments, all of which will shape the cryptocurrency”s trajectory as it navigates a transitional phase in the market.