Bitcoin is currently trading near $91,500 after failing to maintain its position above the $92,000 mark earlier today. Despite posting a minor daily gain, the asset has seen a decline of 1% over the past week. Analysts are closely monitoring technical indicators, particularly the Relative Strength Index (RSI), which has dipped below a critical level that is often associated with strong trend cycles.

The monthly RSI has dropped below 60, raising concerns regarding the current cycle”s strength. Analyst Egrag Crypto had anticipated that the RSI would remain above this threshold, predicting a continuation toward the 80–90 zone, which typically signals a cycle top. Egrag remarked, “We are now in the neutral-to-slightly bearish zone. This area often acts as a decision zone, not a final verdict.” While the RSI is beginning to show signs of upward movement, the overall momentum remains ambiguous. Egrag also noted that if the RSI can reclaim the 60 level, it might reinvigorate the bullish cycle. Otherwise, the market could see a shift toward deeper consolidation, with the next support level around 38.

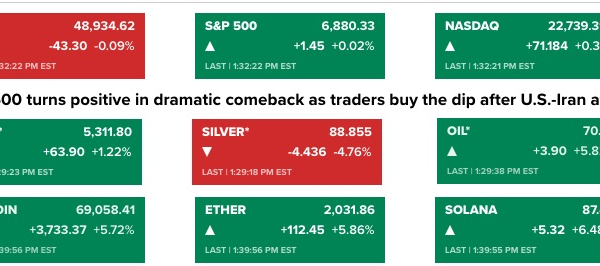

The $92,000 threshold continues to pose a significant barrier for Bitcoin“s price action. Following a brief spike to $92,400 on Monday, BTC quickly retreated, coinciding with rising tensions between U.S. President Trump and Federal Reserve Chair Powell. Since that point, Bitcoin has fallen back below the $92,000 mark. Until the asset breaks through and sustains above this level, the likelihood of a return to the yearly open price increases. Analysts have indicated that increased downside pressure could potentially push Bitcoin toward $70,000 in the coming weeks.

Despite these challenges, Bitcoin has managed to trade above a short-term ascending trendline and the 21-day moving average, which has provided some stability near $90,000. Michaël van de Poppe remarked that Bitcoin is stabilizing and performing relatively well given the global uncertainties. He emphasized the importance of holding above the 21-day moving average, suggesting that this could lead to a gradual climb toward the $94,000 resistance zone.

The $94,000 level represents the next significant resistance point. A breakout above this could pave the way for a move toward $100,400 and beyond. Conversely, a decline below current levels would weaken the existing bullish setup. Analyst CryptosBatman characterized the current market conditions as stagnant, describing Bitcoin“s movement as trapped within a weekly inside bar pattern. He noted that the market is currently lacking excitement, with price oscillating within the highs and lows of the weekly candle from November 17.

Daan Crypto Trades highlighted that the first quarter often yields stronger price action for Bitcoin, noting that previous poor performances were recorded in 2018. Historically, Q1 has brought positive momentum in recent years. Traders remain focused on whether Bitcoin can maintain its support level or if the market is poised for another downward movement.

The situation remains fluid, and investors should keep a close eye on the upcoming technical indicators as the market evolves.