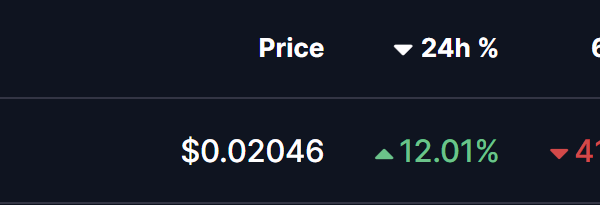

Bitcoin is currently navigating a significant support zone, revealing indications of a potential short-term relief bounce. This price action coincides with the emergence of bullish relative strength index (RSI) divergence, a technical signal that suggests diminishing downside momentum.

Bullish RSI divergence manifests when the price of an asset reaches a lower low while the RSI records a higher low. This scenario often hints at a weakening bearish trend and a possible pause or reversal in the price movement. As Bitcoin stabilizes after recent downward pressure, it has positioned itself near the lower boundary of a descending channel, aligning with the Value Area Low of its broader trading range.

This alignment has drawn the attention of technical traders, especially given the divergence between price and momentum indicators. Although the overarching trend has not fully reversed, these emerging signals imply that bearish momentum might be slowing, thus increasing the likelihood of a short-term relief rally if the support level holds.

Technical analysis highlights several key points for Bitcoin: the channel”s lower support acts as primary structural support, the Value Area Low reinforces the current demand zone, and the 0.618 Fibonacci retracement serves as a potential upside target for any rally that may materialize.

The bullish divergence in the RSI is particularly noteworthy. On lower time frames, Bitcoin“s price has recently established a lower low, while the RSI has recorded a higher low. This divergence indicates that the selling pressure is waning, as the market responds to lower prices with less intensity.

Support confluence is critical in this scenario. Trading at a high-confluence support area, the combination of channel support and the Value Area Low suggests that Bitcoin is entering a zone where previous buyers have deemed value to be attractive. Typically, markets react positively to such areas, often resulting in temporary bounces, especially when selling pressure decreases.

At this junction, Bitcoin has shown signs of a lower-time-frame bounce. Should the price manage to maintain its position above this support level in the coming sessions, it would bolster the case for a short-term bottom forming. It”s worth noting that there has not yet been a decisive breakdown below this critical zone, which could lead to a reflexive rally as late sellers are trapped.

If Bitcoin maintains its position above the current support and establishes a solid base over the next few days, the bullish divergence may facilitate a relief rally toward the 0.618 Fibonacci retracement level. This particular retracement level is often a natural target during corrective rebounds in consolidating markets. While such a move would be corrective and not necessarily indicative of a trend reversal, it serves to reset momentum and alleviate oversold conditions.

Despite these promising short-term indicators, caution remains essential regarding Bitcoin“s broader market structure. The recent decline has continued to exert pressure on higher time frames, and a single divergence cannot confirm a sustained trend reversal. Currently, Bitcoin is in a range-bound environment, characterized by frequent oscillations between support and resistance levels.

In terms of invalidation, the bullish relief-bounce outlook would be negated if Bitcoin were to decisively close below the channel support and Value Area Low, particularly if this move is accompanied by increasing selling volume. Such a development would undermine the divergence signal and raise the risk of further downside exploration.

As things stand, as long as Bitcoin holds above the critical support confluence, the presence of bullish RSI divergence supports the notion of a potential short-term relief bounce. Traders should keep a close watch on whether the price can establish acceptance in this zone and whether any upward movement is accompanied by increased volume. A failure to sustain support would quickly shift the market sentiment back toward a downward continuation, but for the moment, signs of momentum stabilization are beginning to emerge.