Bitcoin experienced a significant rebound on February 6, helping to stabilize the cryptocurrency markets after enduring one of its steepest sell-offs in recent months. This recovery sparked a broad resurgence among major digital assets. Earlier in the week, Bitcoin had briefly plummeted to around $60,000, marking its lowest price point in several months, before buyers returned to the market.

As of the latest updates, Bitcoin has risen to approximately $70,300, reflecting a robust 12% increase from intraday lows. This upward movement has curbed the overall market weakness and reinstated short-term confidence following a wave of liquidation-driven selling.

The recent price action indicates a classic relief bounce after capitulation-like conditions were observed. Data from TradingView indicates that Bitcoin printed a long lower wick in the $60,000 to $62,000 range before climbing higher, with a notable increase in trading volume accompanying the rebound.

Momentum indicators prior to the bounce suggested oversold conditions. The Relative Strength Index (RSI) for Bitcoin had dropped into the low 30s, a level historically linked to short-term exhaustion in corrective phases rather than signaling long-term trend reversals. Although Bitcoin remains significantly below its late-2025 highs, reclaiming the $70,000 level has alleviated immediate downside concerns.

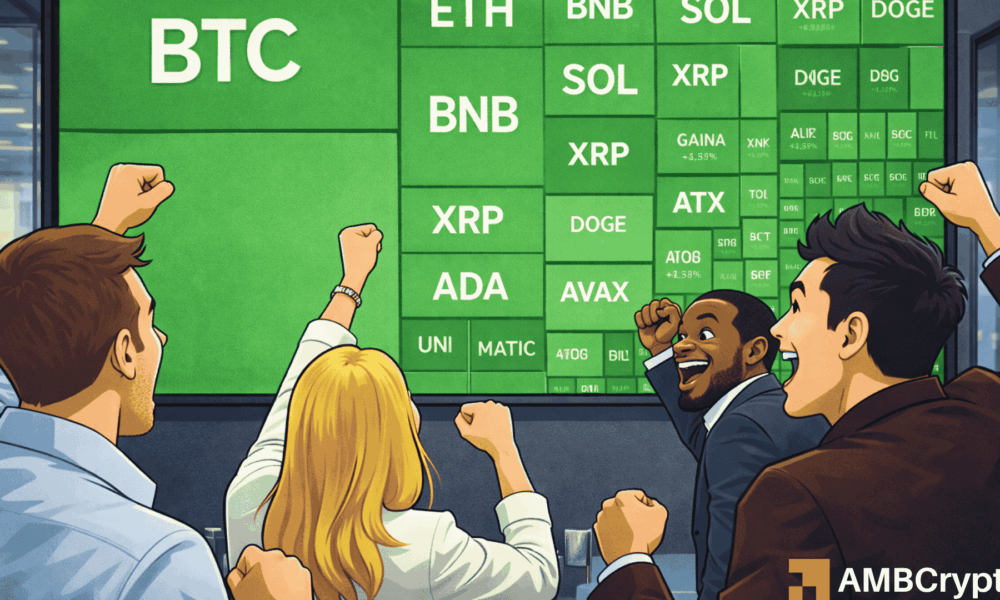

The stabilization of Bitcoin quickly translated to positive movements across the broader cryptocurrency market. A snapshot of the crypto market heatmap from February 6 indicated substantial gains across large-cap assets:

- Ethereum increased by more than 7%.

- Solana rose over 6%.

- BNB climbed close to 3%.

Several mid- and large-cap altcoins also demonstrated high single- to double-digit rebounds. This synchronized recovery suggests that the market”s rebound was driven by a shift in positioning across the board rather than specific asset-related catalysts.

Stablecoins, such as USDT, remained relatively unchanged, indicating that capital was flowing back into risk assets rather than attracting new inflows.

On-chain and cycle indicators still reflect subdued conditions compared to historical market peaks. The Puell Multiple, which gauges miner revenue stress, is currently around 0.71, a level typically indicative of undervaluation rather than market overheating. Additionally, Pi Cycle Top indicators are inactive, with key moving averages remaining widely separated—this suggests that the market is not displaying characteristics typical of a late-cycle environment.

The implications of this rebound for the market are significant. Bitcoin“s recovery has momentarily restored equilibrium following a sharp deleveraging event, reducing immediate downside pressure across the cryptocurrency landscape. However, volatility continues to be elevated, and prices still linger well below recent highs. For the rebound to indicate a definitive trend reversal, it will require confirmation through sustained buying, improvements in macroeconomic conditions, or renewed institutional interest.

In conclusion, while Bitcoin“s performance has provided a temporary respite, market participants should remain cautious and attentive to potential indicators of a more sustained recovery.