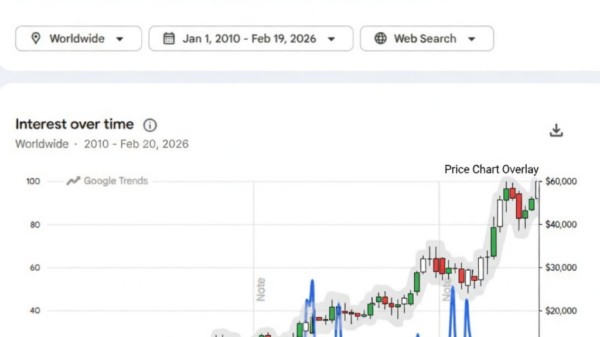

The cryptocurrency market is currently witnessing heightened interest in Bitcoin (BTC) as it struggles to maintain its value below the $70,000 threshold. Recent data from Solid Intel, an independent on-chain analytics platform, reveals a significant uptick in searches for the phrase “Bitcoin is dead” on Google Trends. This trend underscores a prevailing sentiment of fear among investors.

According to charts shared by Solid Intel, the search query has reached near its all-time high (ATH) this February, peaking at 100 while Bitcoin was trading around $68,000. Such spikes in search activity typically occur during periods of market downturns, and the current bearish sentiment aligns with this historical observation.

In the past 30 days, Bitcoin has experienced a substantial decline, losing over 24% of its value amid a backdrop of overall market volatility. The asset has been on a downward trajectory since late January 2026 when it was valued at over $88,000. A recent report from VanEck highlights that Bitcoin has undergone a severe drawdown of approximately 29%, suggesting that the worst of the selling pressure may be subsiding. This drawdown has likely purged many market speculators, leaving sellers increasingly fatigued.

Bitcoin has exhibited fluctuations between a low of $66,452.48 and a high of $68,260.47 during this turbulent period. At the time of reporting, Bitcoin was trading at $68,175.67, reflecting a slight increase of 0.48% within the last 24 hours. Additionally, trading volume has surged by 23.88%, reaching $41.93 billion in the same timeframe.

Technical indicators currently reflect extreme fear in the market, with a fear index rating of 14, close to its yearly low of five. Historically, such pervasive fear has often set the stage for sharp recoveries once market sentiments shift. However, institutional interest appears muted as larger holders remain cautious in the face of ongoing volatility.

Despite the general trend of caution among institutional investors, some Bitcoin whales are seizing the opportunity to accumulate. On-chain analyst Ali Martinez has reported that these large holders have acquired over 30,000 BTC in just a week, suggesting a potential belief in an imminent price rebound amid the current market challenges.