In the wake of the April 2024 halving, the landscape of bitcoin mining is undergoing a significant transformation. Miners are no longer solely focused on hashing power; they are pivoting towards Artificial Intelligence (AI) and High-Performance Computing (HPC). As many publicly traded mining companies face reduced block rewards and tighter profit margins, a strategic shift is becoming evident.

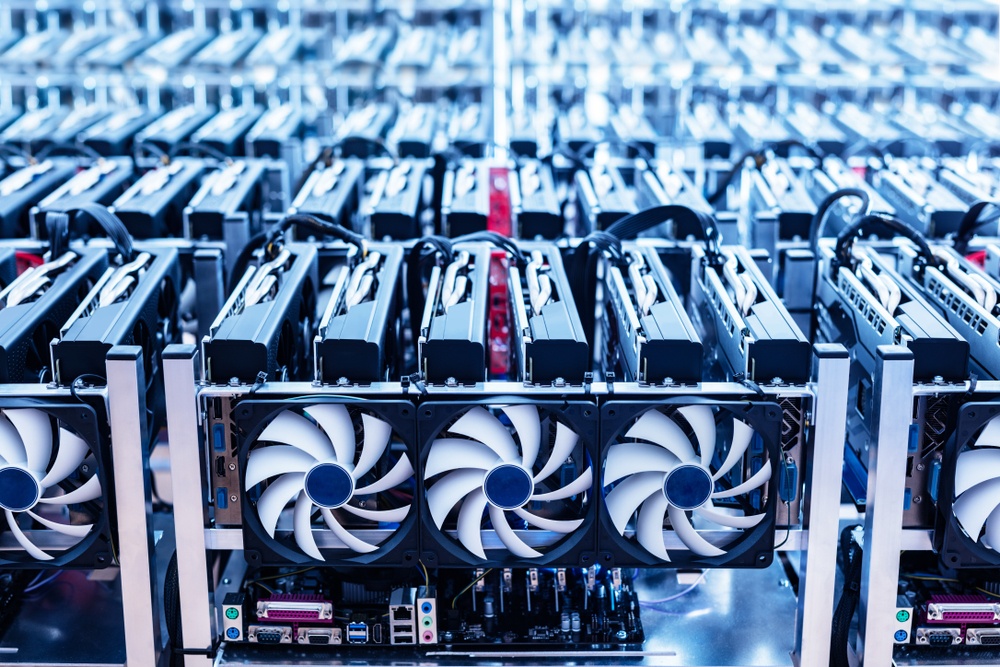

By late 2024 and into 2025, an increasing number of mining firms began to leverage their substantial energy resources for AI workloads. The unpredictable nature of mining revenue has prompted companies to explore new avenues for monetization. Instead of depending primarily on bitcoin production, these firms started utilizing their electrical capacity to host GPU-intensive AI clusters. This transition has often necessitated the liquidation of portions of their bitcoin treasuries to fund necessary upgrades and expansions of their data centers.

Leading this charge is TeraWulf, which has swiftly redefined itself as a hybrid energy and AI infrastructure provider. By early 2025, TeraWulf had firmly established itself as a prime example of how miners are morphing into large-scale data center operators. A significant driver of this evolution has been its partnership with Google, which has increased its equity stake in TeraWulf to 14% and pledged a $3.2 billion backstop to bolster the upgrade of the Lake Mariner facility for AI workloads.

TeraWulf”s strategy involves liquidating a substantial portion of its bitcoin holdings, prioritizing the expansion of its infrastructure over accumulating more BTC. The company has secured long-term contracts for AI hosting, including a notable 10-year agreement with Fluidstack, which could potentially generate revenue of $8.7 billion if lease extensions are exercised. Furthermore, recent acquisitions of sites in Kentucky and Maryland have enhanced TeraWulf”s total power capacity to approximately 2.8 gigawatts, positioning it as one of the most energy-rich operators in the industry.

TeraWulf is not an isolated case; at least eight other major miners have similarly announced strategic pivots towards AI and HPC. For instance, Cango sold 4,451 BTC, valued at around $305 million, to pay off debt and fund its venture into distributed AI computing. Core Scientific has entered into a 12-year agreement with CoreWeave, with projections indicating a revenue generation of $4.7 billion. Meanwhile, Bitdeer reduced its BTC treasury in early 2026 to finance its AI infrastructure growth.

The appeal of AI hosting lies in its potential for stable and long-term revenue streams, especially given the volatility inherent in bitcoin mining, influenced by price fluctuations, network difficulty, and halving cycles. The synergy between existing mining infrastructure and AI requirements makes this transition logical. Miners possess high-capacity substations, industrial cooling systems, and extensive physical footprints, which are precisely the assets that major tech firms need.

As competition intensifies for limited electricity supplies, the value of existing power permits is rising. On a revenue-per-megawatt basis, AI contracts can yield up to three times the income compared to traditional bitcoin mining. In light of these developments, the economic rationale for this structural transformation is compelling. What began as a focus on extracting digital gold is now evolving into a robust energy-backed AI infrastructure.

If current trends continue, many former miners may soon find themselves resembling power-centric data center operators rather than traditional crypto enterprises.