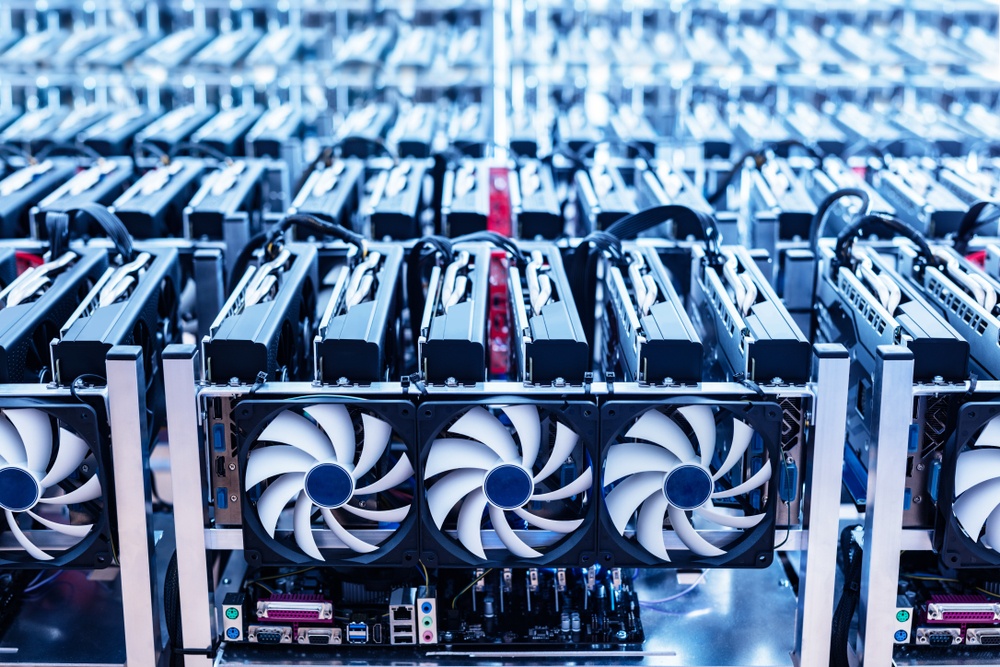

The landscape of cryptocurrency mining is undergoing a significant transformation as miners shift their focus towards Artificial Intelligence (AI) infrastructure. This pivot comes in response to the decreased rewards following the 2024 halving, which has put pressure on profit margins. Companies are now leveraging their substantial energy resources to capitalize on the booming demand for AI data centers.

One of the frontrunners in this transition is TeraWulf, which has redefined its business model to become a hybrid energy and AI infrastructure provider. By early 2025, TeraWulf had notably expanded its operations, bolstered by a strategic partnership with Google. This alliance saw Google increase its equity stake in TeraWulf to 14% and commit a substantial financial backstop to support the upgrade of TeraWulf”s Lake Mariner facility, optimizing it for AI workloads.

To facilitate this evolution, TeraWulf has been liquidating portions of its Bitcoin holdings, prioritizing infrastructure over accumulation. The company has secured long-term AI hosting contracts, including a significant ten-year agreement with Fluidstack, with potential revenues reaching impressive heights if lease extensions are executed. Furthermore, recent acquisitions of sites in Kentucky and Maryland have elevated TeraWulf”s power capacity to approximately 2.8 gigawatts, positioning it among the most energy-efficient operators in the sector.

This trend is not isolated to TeraWulf. At least eight other major miners are making similar strategic shifts towards AI and high-performance computing (HPC). For instance, Cango sold 4,451 BTC, valued at around $305 million, to alleviate debt while transitioning into distributed AI computing. Core Scientific has secured a twelve-year agreement with CoreWeave, expected to generate substantial revenue. Additionally, Bitdeer has reduced its Bitcoin treasury to invest in AI infrastructure.

Miners are drawn to AI for several compelling reasons. Hosting AI workloads generally provides more stable revenue, supported by multi-year contracts, unlike the volatile nature of Bitcoin mining, which is susceptible to market fluctuations and halving cycles. Furthermore, miners possess the necessary infrastructure, including high-capacity substations and industrial cooling systems, which are essential for hyperscalers seeking reliable electricity supplies.

The financial incentives are clear: AI contracts can yield up to three times the revenue of traditional Bitcoin mining on a per-megawatt basis. Given the pressures following the 2024 halving, many miners find the shift toward AI infrastructure increasingly appealing. This structural shift indicates a significant evolution in the industry, where entities that once focused solely on Bitcoin extraction are now becoming major players in the energy-backed AI sector.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.