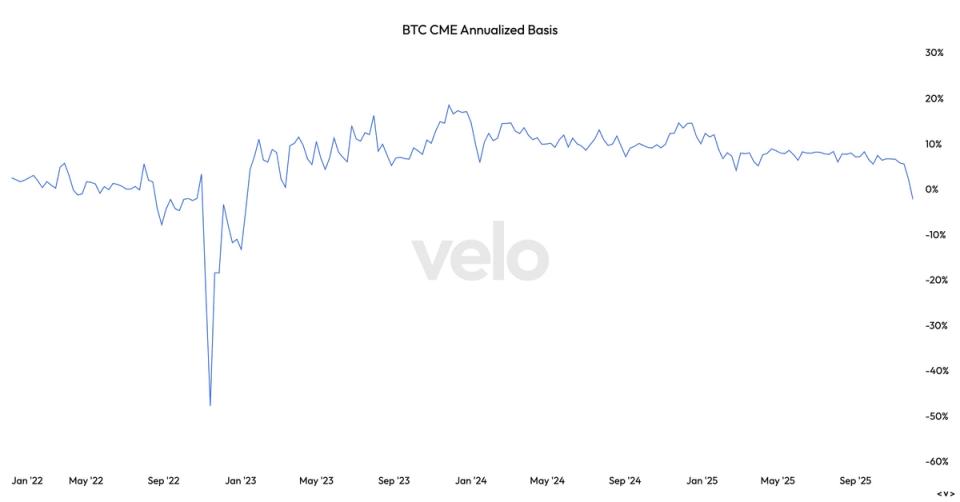

The current landscape of bitcoin futures has revealed a significant shift, as they have entered their deepest state of backwardation since the tumultuous FTX collapse. As reported, the CME bitcoin annualised basis has plummeted to -2.35%, marking a notable contrast to the extreme dislocation experienced in November 2022, where it briefly neared -50%.

Backwardation describes a situation where futures contracts set to expire sooner carry a higher price compared to those set for later dates. This phenomenon indicates that the market anticipates lower prices in the future, as traders adjust their expectations accordingly. This downturn creates a downward sloping futures curve, a scenario that diverges from the typical premium structure known as contango, which usually reflects the high demand for leverage and forward exposure in the bitcoin market.

The recent move into backwardation began to take shape around November 19, just prior to bitcoin”s bottoming out around $80,000 on November 21. During this corrective phase, a significant amount of leverage has been cleared from the market, with traders unwinding long futures positions and institutions scaling back their exposure.

Historically, backwardation has surfaced during periods of market stress or forced de-risking. Notable instances occurred in November 2022, March 2023, August 2023, and now in November 2025, aligning closely with significant market lows. However, it is crucial to note that backwardation does not inherently signal an impending bullish trend.

As highlighted in previous analyses, bitcoin futures differ from physical commodities like oil, where backwardation can indicate a tight supply situation. Instead, CME futures are cash-settled instruments, widely utilized by institutions engaging in basis trading, and can often slip further into negative territory. This suggests that the current backwardation reflects cautious forward pricing and lower expectations rather than a robust demand for spot trading in the near term.

While a substantial portion of leverage has already dissipated from the market, conditions can continue to evolve negatively if the appetite for risk diminishes further. Nonetheless, this backwardation structure has historically signaled potential turning points, especially once forced sellers exhaust their positions. Bitcoin now finds itself in a precarious zone where both risks and opportunities have historically emerged.