In a significant legal development, the United States Supreme Court recently ruled against the controversial tariffs imposed during the Trump administration. This decision deemed the use of emergency powers to enforce these trade duties illegal, creating ripples across various sectors, including cryptocurrency.

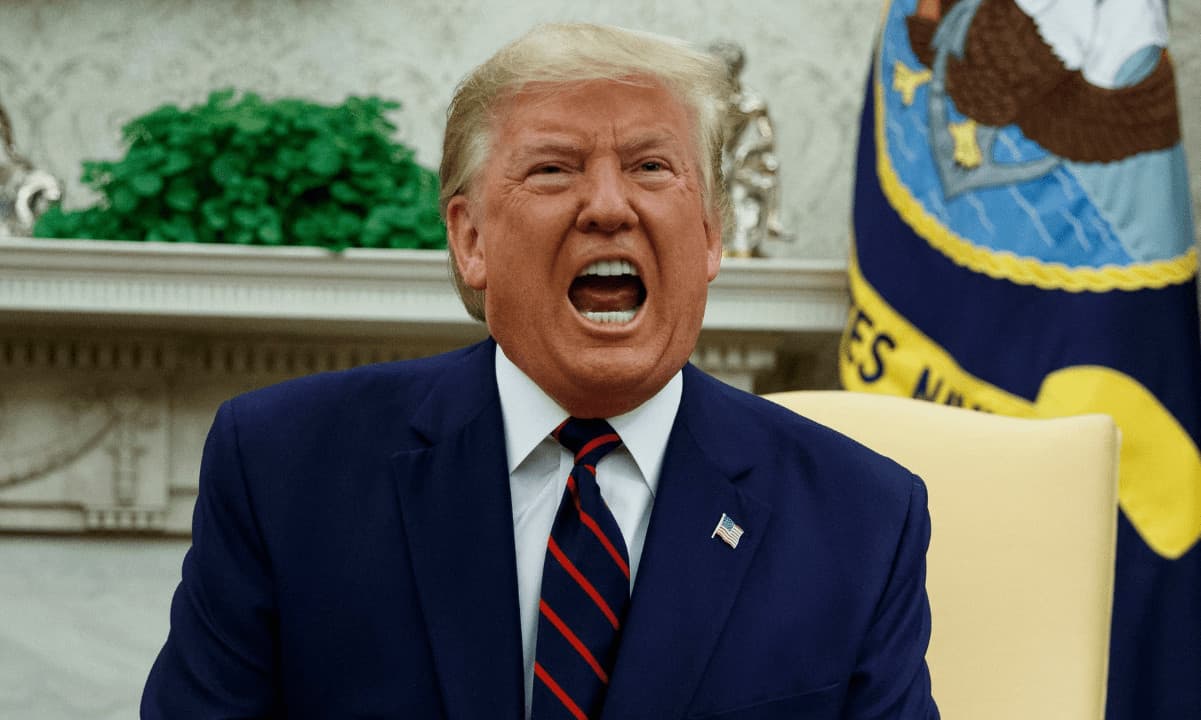

The tariffs, which were projected to generate $1.5 trillion over the next decade from countries like Canada, China, Mexico, and the European Union, faced sharp criticism from former President Trump, who labeled the ruling a “disgrace.” He also hinted at a potential backup plan, suggesting that the issue of tariffs might not be resolved swiftly.

Trade expert Lawrence Herman warned that the ruling would not necessarily end trade tensions. He stated that the tariffs could persist in some form, indicating a likely protracted conflict in US-Canada trade relations, which he described as already “shattered.”

This legal ruling had immediate implications for Bitcoin, which has historically responded negatively to political and economic instability. Following the announcement, the price of Bitcoin saw significant fluctuations, dipping to $66,500 before rapidly rebounding to over $68,000 within minutes. This volatility reflects the intense market reaction to geopolitical developments.

As of now, Bitcoin has settled just under $68,000 after a series of rapid price changes. This event underscores the cryptocurrency”s sensitivity to external factors, particularly those involving trade and regulatory decisions.

The ongoing discourse around tariffs and trade policies will likely continue to impact market sentiment, especially within the cryptocurrency sector, which thrives on stability and investor confidence. Observers will be keen to see how Bitcoin and other cryptocurrencies navigate these turbulent waters in the coming weeks.