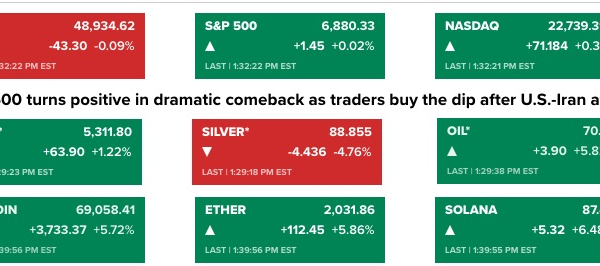

The cryptocurrency space is reeling from a dramatic shift as Bitcoin has fallen below the pivotal $95,000 threshold. Current trading data from Binance indicates that BTC is priced at $94,994.63, a sudden drop that has sent shockwaves throughout the entire crypto ecosystem.

This unexpected decline caught a multitude of investors off guard. Analysts attribute this significant price correction to a mix of factors. Foremost among these is the surge in selling pressure from large holders, which has disrupted market liquidity. Additionally, ongoing global economic uncertainties are affecting investor confidence across a variety of risk assets, including digital currencies.

Technical analysis has also shed light on this price movement. The $95,000 mark was viewed as a crucial psychological support level. Once this threshold was breached, it triggered a wave of automated sell orders and stop-loss positions, which further accelerated the downturn. However, seasoned traders often interpret such corrections as healthy adjustments, presenting new buying opportunities.

Implications for Cryptocurrency Investors

For cryptocurrency investors, understanding market cycles is essential. The current price action of Bitcoin highlights several key market dynamics:

- Volatility remains a staple of cryptocurrency markets.

- Critical support levels can prompt substantial price shifts.

- Market sentiment can rapidly change following technical breakdowns.

- Trading volume typically spikes during significant price fluctuations.

For those invested in the long term, these price swings illustrate normal market behavior. Despite the recent dip, the fundamental value proposition of Bitcoin remains intact. Many analysts view these price corrections as opportunities for those who may have missed earlier entry points.

Strategies for Managing Price Volatility

Effective cryptocurrency investing requires a strategic approach during times of volatility. During notable price movements, consider the following strategies:

- Dollar-cost averaging can mitigate timing risks.

- Portfolio diversification helps manage overall exposure.

- Risk management is vital to shield against extreme volatility.

- Fundamental analysis supports a long-term perspective.

It is crucial to remember that cryptocurrency markets operate continuously, and price changes can occur swiftly. The current situation with Bitcoin may present varied opportunities for different investor types, ranging from day traders to long-term holders.

What Lies Ahead for Bitcoin Price Trends

Market analysts are closely observing key price levels that could steer future movements for Bitcoin. The range between $94,000 and $95,000 is now critical for assessing short-term momentum. A sustained break below this zone may lead to tests of lower support levels, while a rebound above $96,000 could indicate renewed bullish sentiment.

Despite the current fluctuations, institutional interest in Bitcoin continues to rise. Major financial institutions and corporations are maintaining their exposure to BTC, signaling confidence in its long-term value proposition. This institutional participation can often lend stability during periods of volatility driven by retail investors.

In conclusion, the cryptocurrency market has once again proven its dynamic nature through the recent movements in Bitcoin prices. Although the breach below $95,000 is newsworthy, experienced investors recognize these fluctuations as routine market behavior. The ongoing narrative of fundamental adoption is evolving, with technological advancements and institutional integration progressing consistently.

Market corrections tend to reveal the distinction between emotional reactions and strategic investment decisions. Successful investors typically prioritize long-term trends over fleeting price changes. The recent price action of Bitcoin is a stark reminder of the importance of risk management and disciplined investment approaches in highly volatile markets.

Frequently Asked Questions

Why did Bitcoin price drop below $95,000? The decline was driven by a combination of technical factors, increased selling pressure, and shifts in broader market sentiment.

Should I sell my Bitcoin during this price drop? Investment decisions should be aligned with your financial objectives and risk appetite. Many investors take advantage of dips as buying opportunities, while others hold their positions regardless of short-term fluctuations.

How low could Bitcoin price go? While exact predictions are impossible, technical analysts are keeping an eye on support zones around $92,000 and $90,000, where buying interest might resurface.

Will Bitcoin price recover quickly? Cryptocurrency markets can rebound rapidly, but the timing of recovery will depend on various factors, including market sentiment and trading volume.

Is this a good time to buy Bitcoin? Price corrections often attract buyers seeking favorable entry points, but thorough personal research and consideration of your investment strategy are essential before making decisions.

How does this affect other cryptocurrencies? Movements in Bitcoin prices generally influence the broader cryptocurrency market, with many altcoins displaying a correlated price action during significant shifts in BTC.

For more insights on Bitcoin trends, check out our detailed articles on key developments shaping Bitcoin“s price actions and institutional adoption.